Indirect Taxes

- Customs

- Advance Rulings

- Audit

- Background

- Classification of Goods under The Customs Tariff Act, 1975

- Customs Duty Drawbacks

- Date for Determining Rate of Duty and Valuation

- Demand, Recovery and Refund of Duty

- Interest

- Levy of Customs Duty

- Penalties

- Procedure of Import

- Prosecution

- Settlement of Cases

- Some Important Definitions

- Types of Duties

- Valuation of Goods

- Warehousing

- Goods and Services Tax (GST)

- Accounts and Records

- Assessments and Audits

- Classification of Goods and Services

- E-Way Bill

- Input Tax Credit (ITC)

- Interest

- Penalties & Prosecution

- Place of Supply

- Refund

- Registration

- Relevant Circulars - Miscellaneous

- Returns

- Reverse Charge Mechanism under Goods and Services Tax (GST)

- Supply with Schedules

- Time of Supply

- Transitional Provisions

- Valuation of Supplies

- Maharashtra Profession Tax

- Maharashtra Value Added Tax

- Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019

- Service Tax

VALUATION OF GOODS

As per Section 14 of the Customs Act, the value of imported goods or export goods is the transaction value. The Transaction Value is defined as ‘price paid or payable for the goods’. If the value cannot be determined under Section 14, the importer shall resort to Customs Valuation (Determination of Value of Imported Goods) Rules, 2007 (hereinafter referred to as ‘Import Valuation Rules’) or Customs Valuation (Determination of Value of Export Goods) Rules, 2007 (hereinafter referred to as ‘Export Valuation Rules’) to determine value of export goods.

Further, the price shall be calculated with reference to the rate of exchange as in force on the date on which BOE for home consumption or Shipping Bill or Bill of Export are presented.

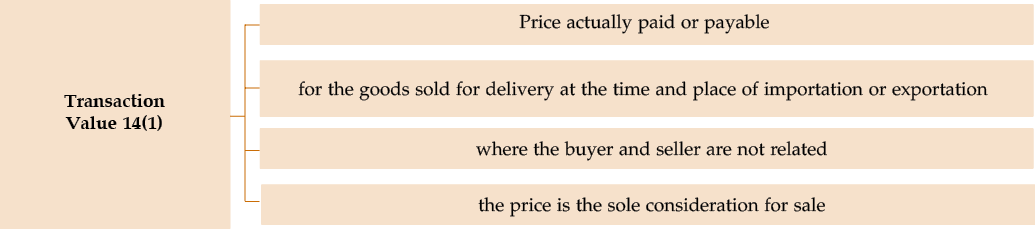

- Meaning of Transaction Value

As per Section 14 of the Customs Act, the value of imported goods or exported goods shall be the transaction value.

|

Section 14(2) provides that CBIC may notify tariff value for any class of imported/ export goods.

‘Related person’ is defined in Rule 2(2) of the Customs Valuation (Determination of Value of Imported/Export Goods) Rules, 2007 as follows:

For the purpose of these rules, Persons shall be deemed to be ‘related’ only if-

Sole agent or sole distributor or sole concessionaire associated with any person shall be deemed to be related for the purpose of these rules, if they fall within the criteria of this sub-rule. The term “person” also includes legal persons. |

It may be noted that if for any transaction all the above conditions are not fulfilled cumulatively, one needs to resort to Rules for valuation of imported or export goods.

- Import Valuation Rules

In case, the value of imported goods cannot be determined under Section 14 of the Customs Act, the value shall be determined on the basis of provisions contained in Customs Valuation (Determination of value of imported goods) Rules, 2007.

Transaction value in the case of imported goods shall include, in addition to the price as aforesaid, any amount paid or payable for costs and services, including commissions and brokerage, engineering, design work, royalties and licence fees, costs of transportation to the place of importation, insurance, loading, unloading and handling charges as prescribed in the rules.

|

S. No. |

Method of valuation of Imported Goods (in sequential order) |

Rule |

|---|---|---|

|

1. |

Transaction Value of imported goods |

Rule 3 |

|

2. |

Transaction Value of Identical Goods |

Rule 4 |

|

3. |

Transaction Value of similar goods |

Rule 5 |

|

4. |

Determination of value when cannot be determined under Rule 3, 4 & 5 |

Rule 6 |

|

5. |

Deductive value based on identical/ similar imported goods |

Rule 7 |

|

6. |

Computed Value |

Rule 8 |

|

7. |

Best Judged Value/ Residual Method |

Rule 9 |

|

8. |

Cost and services liable to be included in TV |

Rule 10 |

|

9. |

Valuation declaration |

Rule 11 |

|

10. |

Rejection of declared TV |

Rule 12 |

|

11. |

Interpretative notes to be used for interpretation of these Rules (Schedule providing interpretative notes for interpretation of above Rules above is provided with these Rules) |

Rule 13 |

Out of the above rules, brief note on important rules is provided hereunder:

Rule 3: (Determination of the method of Valuation)

Transaction value shall be accepted provided;

- No restriction on disposition or use of goods by the buyer except restriction imposed by any statutory provisions or limiting the geographical area or restriction does not substantially affect the value of the goods

- Sale or price not subject to conditions or consideration for which value cannot be determined

- No further consideration to accrue directly or indirectly to seller unless adjustable as per Rule 10

- Buyer and seller are Unrelated

If they are related, the Transaction Value is accepted on examination of circumstances of sale which shall indicate that relationship did not influence the price and importer proves that price is close to the transaction value of identical/ similar goods, in sales to unrelated buyers; deductive/ computed value of identical/ similar goods

If the value of imported goods cannot be determined under Rule 3, value shall be determined by applying following rules (Rule 4 to 9) sequentially:

|

Rule |

Method of valuation of Imported Goods (in sequential order) |

|---|---|

|

Rule 4 |

Transaction Value of Identical Goods-

The term ‘identical goods’ have been defined in Rule 2(d) of the Import Valuation Rules, 2007. |

|

Rule 5 |

Transaction Value of Similar Goods-

The term ‘similar goods’ have been defined in Rule 2(f) of the Import Valuation Rules, 2007 Provided value of similar goods should not have been provisionally assessed |

|

Rule 6 |

Determination of value when cannot be determined under Rule 3,4 & 5, it has to be determined as per Rule 7 and 8 sequentially However, at the request of the importer and with the approval of proper officer, order of application of Rules 7 and 8 can be reversed |

|

Rule 7 |

Deductive value based on identical/ similar imported goods – If goods being valued or identical or similar goods are sold in India, in same condition as imported at or about the same time, the assessable value shall be Unit Price at which imported/identical/similar imported goods are sold in greatest aggregate quantity to unrelated persons in India but subject to following deductions-

|

|

Rule 8 |

Computed Value- Value of imported goods shall be based on a computed value, which is sum of =

|

|

Rule 9 |

Best Judged Value/ Residual Method- If the value cannot be determined based on the above rules, it shall be determined by applying reasonable means consistent with the principles and general provisions of these rules and on the basis of data available in India Value so determined shall be less than or equal to the Normal price of such goods in the course of international trade |

|

Rule 10 (1) |

Cost and services to be included in Transaction Value- The adjustments shall be made for the following cost and services and cost to be added if not included-

|

|

Rule 10 (2) |

Transaction Value shall include-

If Transportation cost is not ascertainable, 20% of the FOB value of the goods shall be added to such cost. Provided where FOB value is not ascertainable but sum of FOB value and Insurance Cost is ascertainable, Transport Cost shall be 20% of such sum. If Insurance Cost is not ascertainable, cost shall be 1.125% of FOB value of the goods. Provided where FOB value is not ascertainable but sum of FOB value of the goods and transportation cost is ascertainable, cost of insurance shall be 1.125% of such sum. In case where import is by air and Transaction Cost is ascertainable, Transaction Cost should not exceed 20% of FOB In case goods are imported by sea or air and transshipped to another customs station in India, the cost of insurance, transport, loading, unloading, handling charges associated with such transshipment shall be excluded. Note: Said rule emerged after changes vide Notification No.-91/2017-Customs (NT) dated 26.09.2017. Further, Ad Hoc addition of 1% of FOB value came to struck down by Hon’ble Supreme Court in the case of Wipro Ltd. vs. Assistant Collector of Customs 2015 (319) ELT 177 (SC). |

|

Rule 11 |

Valuation declaration for determination of value of Imported Goods- Importer or his agent shall furnish declaration disclosing full and accurate details relating to the value of imported goods; any other statement, information or document including an invoice of the manufacturer or producer of the imported goods where the goods are imported from or through a person other than the manufacturer or producer |

|

Rule 12 |

Rejection of declared Transaction Value- If Customs authorities have reason to doubt the truth or accuracy of the declared value in terms of these Rules, the valuation shall be carried out by other methods |

|

Rule 13 |

Interpretative notes to be used for interpretation of these Rules (Schedule providing interpretative notes for interpretation of above Rules above is provided with these Rules) |

- Export Valuation Rules-

In case, the value cannot be determined under Section 14 of the Customs Act, the value shall be determined on the basis of provisions contained in Customs Valuation (Determination of Value of Export Goods) Rules, 2007.

|

Rule |

Description |

|---|---|

|

Rule 3 |

Conditions for acceptance of transaction value (TV)- Unless rejected by the proper officer under Rule 8, the value of export of goods shall be the transaction value. The Transaction Value shall be accepted even where the buyer and seller are related provided the relationship has not influenced the price. Further, Rules 4 to 6 of said Rules needs to be sequentially followed if buyer and seller are related and the price is influenced by the relationship or where price is not the sole consideration for sale. |

|

Rule 4 |

Determination of export value by comparison- The value of the export goods shall be based on

The Proper officer shall make reasonable adjustments, taking into consideration the relevant factors, including adjustment for difference in dates, commercial levels, quantity levels, composition, quality, design, freight and insurance |

|

Rule 5 |

Computed Value- shall include cost of production, charges for design or brand and amount towards profit |

|

Rule 6 |

Best Judged Value/Residual method- In case of failure to determine value as per above Rules, residual method shall be applied using reasonable means consistent with the principles and general provisions of these rules provided that local market price of the export goods may not be the only basis for determining the value of export goods |

|

Rule 7 |

Valuation declaration- Exporter shall furnish a declaration relating to the value of export of goods in the manner as prescribed in this behalf |

|

Rule 8 |

Rejection of declared Transaction Value- If proper officer has reason to doubt the truth and accuracy of the value declared, best judgment assessment shall be done as laid down in this Rule |

- Valuation as per GST in case of imports and exports-

For the purpose of calculating IGST20, the value of imported article shall be the aggregate of-

- the value as per Section 14(1) (i.e. transaction value) or Section 14(2) (tariff value in respect of notified goods) of the Customs Act, 1962 and

- any duty of customs but does not include IGST and GST Compensation Cess

For the purpose of calculating IGST21, the value of export goods shall be governed by provisions of GST Law.