Indirect Taxes

- Customs

- Advance Rulings

- Audit

- Background

- Classification of Goods under The Customs Tariff Act, 1975

- Customs Duty Drawbacks

- Date for Determining Rate of Duty and Valuation

- Demand, Recovery and Refund of Duty

- Interest

- Levy of Customs Duty

- Penalties

- Procedure of Import

- Prosecution

- Settlement of Cases

- Some Important Definitions

- Types of Duties

- Valuation of Goods

- Warehousing

- Goods and Services Tax (GST)

- Accounts and Records

- Assessments and Audits

- Classification of Goods and Services

- E-Way Bill

- Input Tax Credit (ITC)

- Interest

- Penalties & Prosecution

- Place of Supply

- Refund

- Registration

- Relevant Circulars - Miscellaneous

- Returns

- Reverse Charge Mechanism under Goods and Services Tax (GST)

- Supply with Schedules

- Time of Supply

- Transitional Provisions

- Valuation of Supplies

- Maharashtra Profession Tax

- Maharashtra Value Added Tax

- Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019

- Service Tax

LEVY OF CUSTOMS DUTY

Customs Act applies to the whole of India [and also to any offence or contravention under the Customs Act committed outside India by any person]1.

Customs duty shall be levied on imports into or exports from India vide Section 12 of the Customs Act, 1962 (hereinafter referred to as the ‘Customs Act’) at the rates prescribed under the Customs Tariff Act, 1975 read with the relevant exemption notification/s.

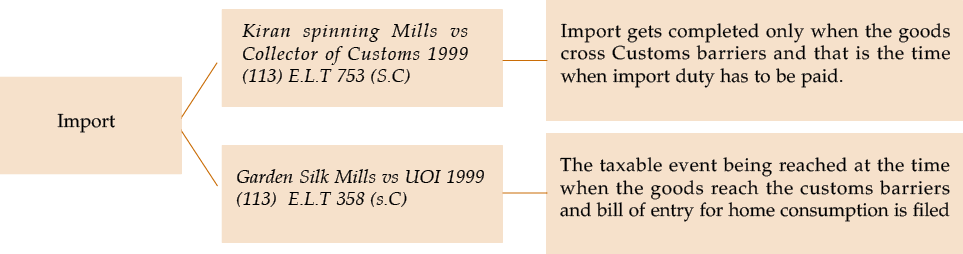

Import2 is defined as ‘import, with its grammatical variations and cognate expressions, means bringing into India from a place outside India’.

|

Export3 is defined as ‘Export, with its grammatical variations and cognate expressions, means taking out of India to a place outside India’. Export means taking goods to a place outside India and such place would include high seas as held in case of Collector of Customs, Calcutta vs. Sun Industries 1988 (35) ELT 241 (SC). It would be pertinent to note that export duties are applicable to a handful of commodities.