Indirect Taxes

- Customs

- Advance Rulings

- Audit

- Background

- Classification of Goods under The Customs Tariff Act, 1975

- Customs Duty Drawbacks

- Date for Determining Rate of Duty and Valuation

- Demand, Recovery and Refund of Duty

- Interest

- Levy of Customs Duty

- Penalties

- Procedure of Import

- Prosecution

- Settlement of Cases

- Some Important Definitions

- Types of Duties

- Valuation of Goods

- Warehousing

- Goods and Services Tax (GST)

- Accounts and Records

- Assessments and Audits

- Classification of Goods and Services

- E-Way Bill

- Input Tax Credit (ITC)

- Interest

- Penalties & Prosecution

- Place of Supply

- Refund

- Registration

- Relevant Circulars - Miscellaneous

- Returns

- Reverse Charge Mechanism under Goods and Services Tax (GST)

- Supply with Schedules

- Time of Supply

- Transitional Provisions

- Valuation of Supplies

- Maharashtra Profession Tax

- Maharashtra Value Added Tax

- Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019

- Service Tax

VALUATION OF SUPPLIES IN GST

Legend

Unless otherwise stated, Section in the chapter refers to relevant Section of Central Goods and Services Tax Act, 2017 and Rule refers to Central Goods and Services Tax, Rules 2017.

Background

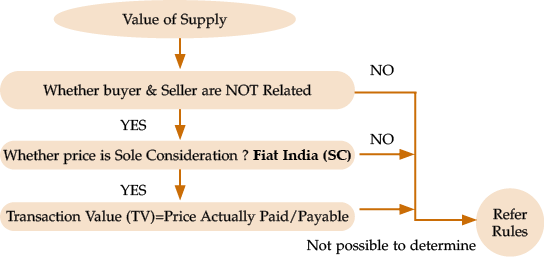

Section 15 of Central Goods and Services Tax Act read with Central Goods and Services Tax Rules, 2017 lays down the principles of valuation, for goods and services. Similar provisions are adopted by Integrated Goods and Services Tax Act, 2017, Union Territory Act, 2017 and Respective Acts and Rules of various States.

|

Essentially, following principles of valuation are to be applied in three buckets, depending on the nature of supply:

|

Sr. No. |

Nature of supply |

Applicable Section |

|---|---|---|

|

1 |

Supply: (a) to a recipient who is not related to the supplier; and (b) where price is the sole consideration |

15(1) |

|

2 |

Supply: (a) to a recipient who is related to the supplier; or (b) where price is not the sole consideration |

15(4) |

|

3 |

Supplies notified by Government |

15(5) |

- Inclusions and Exclusions in the Value of Supply

For each of the above buckets, while determining the value of supply, following amounts are to be included/excluded in/ from transaction value:

|

Amounts to be Included [Section 15(2)] |

Amounts to be Excluded [Section 15(3) and Rule 33] |

|---|---|

|

Any ‘Discount’ which is given— Before or at the time of supply, duly recorded in the invoice issued for such supply; and |

|

After supply, subject to following conditions —

|

|

|

|

Further, as per Rule 33 expenditure/costs incurred by a Supplier as a ‘Pure Agent’ of the Recipient shall be excluded, if following conditions are specified—

- Supplier acts as a “Pure Agent” of Recipient, while making payment to Third Party;

- Payment made by a Pure Agent, separately indicated in the Invoice;

- Supplies procured by the Pure Agent from third party are in addition to the services supplied on his own account.

Meaning of “Pure Agent” as explained in the explanation of the rule is the person who:

- enters into a contractual agreement with the recipient of supply to act as his pure agent to incur expenditure or costs in the course of supply of goods or services or both;

- neither intends to hold nor holds any title to the goods or services or both so procured or supplied as pure agent of the recipient of supply

- does not use for his own interest such goods and/or services so procured; and

- receives only the actual amount incurred to procure such goods and/or services in addition to the amount received for supply he provides on his own account.

2. Value of Supply to Non-related Persons

- Where the price is the sole consideration – the Transaction value

- Where the price is not the sole consideration: Rule 27 prescribes the following in sequential order:

- Open market value of such supply

- Consideration in money equivalent amount of consideration not in money

- Value of supply of like kind and quality

- Sum total of consideration in money and such further amount in money that is equivalent to consideration not in money

3. Value of Supply to Agents, Related Persons or between Distinct Persons

Valuation for supply between a person (being a principal) and his agent (other than sole agent), is prescribed in Rule 29, while valuation of supply between related persons (including sole agent) or between distinct persons is prescribed in Rule 28 – both of which Rules require determination of value as per Rule 30 or Rule 31 in specified situations.

Explanation to Section 15 of the CGST Act, explains the term ‘Related Person’, which states that person shall be related persons if—

- persons are officers or directors of one another’s businesses;

- are legally recognised partners in business;

- are employer and employee;

- any person directly or indirectly owns, controls or holds twenty five per cent or more of the outstanding voting stock or shares of both of them;

- one of them directly or indirectly controls the other;

- both of them are directly or indirectly controlled by a third person;

- together they directly or indirectly control a third person or they are members of the same family

The term “related parties” also includes legal persons and persons who are associated in the business of one another in that one is the sole agent or sole distributor or sole concessionaire, of the other.

Rules 28 to 31 also provide for ‘sequential’ method of arriving at valuation summarised in the table below:

|

Sr. No. |

Method of valuation (in sequential order) |

Supply between principal and agent (other than sole agent) |

Supply between distinct persons and related persons (including sole agent)* |

|---|---|---|---|

|

1 |

Open Market Value of supply (OMV) |

Rule 29 clause (a) |

Rule 28 clause (a)] |

|

2 |

Value of supply of goods/ services of like kind and quality |

N.A. |

Rule 28 clause (b) |

|

3 |

110%_____ of____ cost____ of production/ manufacture/acquisition of goods or cost of provision of services |

Rule 30 |

Rule 30 |

|

4 |

Value using reasonable means consistent with the principles and general provisions of section 15 and Rules |

Rule 31 |

Rule 31 |

|

Option available to supplier – 90% of price charged for goods of like kind and quality by recipient to his unrelated customer |

This option is in place of OMV method only |

This option is in place of all above methods |

|

Second proviso to Rule 28 provides that “If the Recipient is eligible for Full Input Tax Credit — the value declared in invoice shall be deemed to be the Open Market Value of goods or services”. Inclusion of this provision shall avoid possible valuation disputes with Department in above situations.

- Option to determine Value of Notified Supplies Section 15(5) states cases where Recipient may or may not be related or price may or may not be the sole consideration, supplier has option to determine the taxable value as per the method prescribed in Rule 32 for such notified supply.

|

Sr. No. |

Nature/type of supply |

Relevant criteria / optional deemed valuation method prescribed in Rule 32 – depending on specified situations |

|---|---|---|

|

i. |

Value of supply of services in relation to purchase or sale of foreign currency including money changing |

For a currency, when exchanged from, or to, Indian Rupees (INR)—

Option: Value in relation to supply of foreign currency, including money changing—

|

|

ii. |

Value of supply of services in relation to booking of air travel tickets by air travel agent |

Domestic International 5% of Basic Fare 10% of Basic Fare |

|

iii. |

Value of supply of services in relation to Life Insurance Business (other than pure risk cover policies |

|

|

iv. |

Dealer engaged in Buying and selling of second hand goods |

Taxable Value of supply would be the difference between Selling Price and Purchase Price subject to the following Conditions—

Note: Where the value is negative, it shall be ignored |

|

v. |

Goods purchased from defaulting unregistered borrower, for recovery of loan/debt |

The purchase price of such borrower reduced by 5% for every quarter/ part thereof between date of purchase and date of disposal by such person making repossession. |

|

vi. |

Token voucher, coupon or stamp (other than postage stamp) redeemable against supply of goods/ services |

Taxable Value shall be the money value of the goods or services or both redeemable against such token, voucher, coupon, or stamp. |

|

vii. |

Taxable services provided by notified class of service providers from out of persons having more than one registrations under different GST Acts but treated as distinct persons (referred to in Para 2 of Schedule I of CGST Act), where ITC is available |

Taxable Value of Supply will be ‘Nil’ in such a case. Note: Circular No. 1/1/2017- IGST dated 7th July, 2017 provides that in case of Trains, Buses, Trucks, Tankers, Trailers, Vessels, Containers, Aircraft carrying goods or passengers or both; or for repairs and maintenance, [except in cases where such movement is for further supply of the same conveyance] will not be regarded as either supply of goods or supply of services |

- Rate of Exchange and Value Inclusive of GST

Rule 34 provides Rate of exchange of currency, other than Indian rupees, for determination of value of taxable goods and services shall be—

|

Taxable amount for Goods |

- |

Rate of exchange as per Section 14 of the Customs Act, 1962 in accordance with the date of time of supply as per Section 12 of CGST Act |

|

Taxable amount for Services |

- |

Applicable rate of exchange determined as per the generally accepted accounting principles for the date of time of supply of service in accordance with Section 13. |

- Value of supply in case of lottery, betting, gambling and horse racing w.e.f 23-01-2018

|

the value of supply of lottery RUN by State Governments |

Deemed to be Higher of 100/112 of the face value of ticket or of the price as notified in the Official Gazette by the organising State, |

|

The value of supply of lottery AUTHORISED by State Governments |

Deemed to be Higher of 100/128 of the face value of ticket or of the price as notified in the Official Gazette by the organising State |

|

The value of supply of actionable claim in the form of chance to win in betting, gambling or horse racing in a race club |

100% of the face value of the bet or the amount paid into the totalisator |

- Value of supply which is inclusive of Integrated Tax, Central Tax, State Tax, Union Territory Tax

Rule 35, provides that where value of supply is inclusive of GST,

Tax amount would be = Value inclusive of taxes X tax rate in % of IGST or as the case may be CGST, SGST or UTGST/(100+ sum of tax rates, as applicable, in %)