Indirect Taxes

- Customs

- Advance Rulings

- Audit

- Background

- Classification of Goods under The Customs Tariff Act, 1975

- Customs Duty Drawbacks

- Date for Determining Rate of Duty and Valuation

- Demand, Recovery and Refund of Duty

- Interest

- Levy of Customs Duty

- Penalties

- Procedure of Import

- Prosecution

- Settlement of Cases

- Some Important Definitions

- Types of Duties

- Valuation of Goods

- Warehousing

- Goods and Services Tax (GST)

- Accounts and Records

- Assessments and Audits

- Classification of Goods and Services

- E-Way Bill

- Input Tax Credit (ITC)

- Interest

- Penalties & Prosecution

- Place of Supply

- Refund

- Registration

- Relevant Circulars - Miscellaneous

- Returns

- Reverse Charge Mechanism under Goods and Services Tax (GST)

- Supply with Schedules

- Time of Supply

- Transitional Provisions

- Valuation of Supplies

- Maharashtra Profession Tax

- Maharashtra Value Added Tax

- Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019

- Service Tax

REFUND

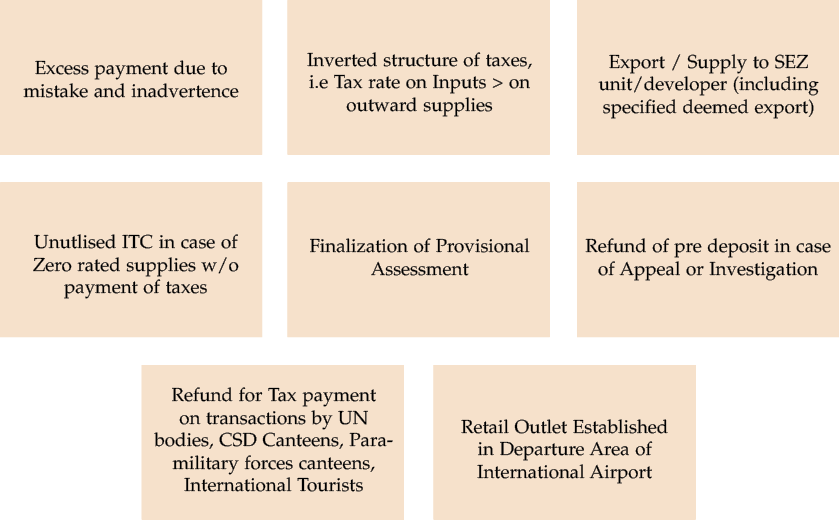

Situations for Refund

|

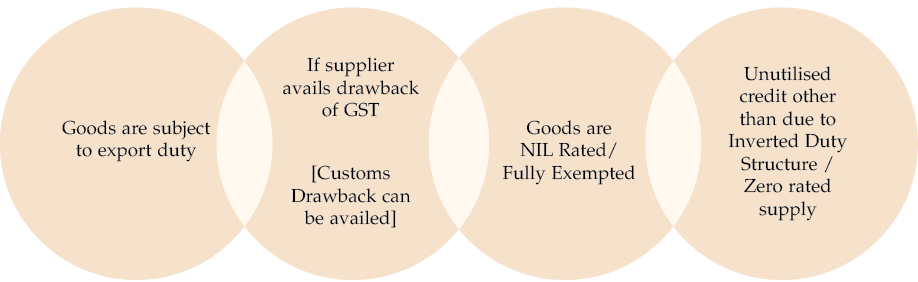

Situations for No Refund

|

Refunds – Law at Glance

- Proof of satisfying Principle of Unjust Enrichment is on tax payer

- Self Certification in Annex 1 of GST RFD 01 by Tax payers for refund below ₹2 lakhs

- CA / CMA Certificates in Annex 2 of GST RFD 01 for taxpayers beyond threshold limit of ₹2 lakhs

- Application of refund shall be accompanied by documentary evidence [GST (Refund) Rules 89]

- Shipping Bill filed by an exporter shall be deemed to be an application for refund of IGST paid on goods exported out of India [Rule 96]

- Realization of Proceeds in Foreign Convertible Exchange is a pre-condition for Services Exports – Thus BRC or FIRC are must for claiming Refund for Export of Services. This condition is relaxed in cases where Reserve Bank of India permits receipt of consideration in Indian rupees for service exports.

- If refund is claimed with respect to export of goods, sales proceeds must be realised within period allowed under Foreign Exchange Management Act, 1999

- Refund of Tax u/s 77 – If IGST was paid on transaction which turned out to be intra state or vice versa.

- Date of communication shall be the relevant date for interest liability

- Interest shall be paid on delayed refunds at notified rate not more than 6% if delay in paying refund after 60 days of receipt of application.

- A period of TWO YEARSfrom the relevant date may be allowed for filing of refund application

- A period of SIX MONTHSfrom the last day of the month in which such supply is received, Refund application be allowed for Embassy/International Organizations

Relevant Dates for Filing Refunds

|

Situation |

Relevant Date for Filing Refund |

|---|---|

|

On account of Export of Goods where a refund of tax paid is available in respect of the goods themselves or, as the case may be, the inputs or input services used in such goods |

|

|

if the goods are exported by sea or air |

the date on which the ship or the aircraft in which such goods are loaded, leaves India |

|

if the goods are exported by land |

the date on which such goods pass the frontier |

|

if the goods are exported by post |

the date of despatch of goods by the Post Office concerned to a place outside India |

|

in the case of supply of goods regarded as deemed exports where a refund of tax paid is available in respect of the goods |

the date on which the return relating to such deemed exports is filed |

|

On account of Export of Services where a refund of tax paid is available in respect of services themselves or, as the case may be, the inputs or input services used in such services |

|

|

where the supply of service had been completed prior to the receipt of such payment |

Date of receipt of payment in convertible foreign exchange |

|

where payment for the service had been received in advance prior to the date of issue of the invoice |

Date of issue of invoice |

|

In pursuance of an appellate authority, Appellate Tribunal or Court order in favor of the taxpayer. |

Date of communication of the such judgement, decree, order or direction of respective authority |

|

On account of refund of accumulated ITC due to inverted duty structure. |

Due date for furnishing of return under section 39 for the period in which such claim for refund arises |

|

On account of finalization of provisional assessment for tax paid provisionally |

Date of adjustment of tax after the final assessment |

|

in the case of a person, other than the supplier, |

the date of receipt of goods or services by such person |

|

For refund arising out of payment of GST on petroleum products, etc. to Embassies or UN bodies or to CSD canteens, etc. on the basis of applications filed by such persons. |

Date of receipt of goods or services or both |

|

Any other Case |

Date of payment of GST |

Refund Forms

|

Form No |

Purpose |

|

GST RFD-01 |

Refund Application form |

|

– Annexure 1 Details of Goods / Services |

|

|

– Annexure 2 Certificate by CA |

|

|

GST RFD-01A in lieu of GSTR -01 |

Manual refund application (prior to 26/09/2019) |

|

GST RFD-02 |

Acknowledgement |

|

GST RFD-03 |

Notice of Deficiency on Application for Refund |

|

GST RFD-04 |

Provisional Refund Sanction Order |

|

GST RFD-05 |

Payment advice for Refund / Credit to Consumer Welfare Fund |

|

GST RFD-06 |

Refund Sanction Order / Rejection of Refund Order |

|

GST RFD-07 |

Order for Complete adjustment of claimed Refund |

|

GST RFD-08 |

Show cause notice for reject of refund application |

|

GST RFD-09 |

Reply by applicant to show cause within 15 days |

|

GST RFD-10 |

Refund application form for Embassy/International Organizations |

|

GST RFD-10A |

Refund application by Canteen Stores Department (CSD) |

|

GST RFD-10B |

Refund of taxes to retail outlets established in departure area of International Airport beyond immigration counter making tax free supply to an outgoing international tourist |