Company Law

- Abbreviations

- Acceptance of Deposits [Ch. V]

- Accounts of companies [Ch. IX]

- Accounts of companies [Ch. IX]

- Appointment and Remuneration to Managerial Personnel [Ch. XIII]

- Appointment and Remuneration to Managerial Personnel [Ch. XIII]

- Appointment and qualification of directors [Ch. XI]

- Appointment and qualification of directors [Ch. XI]

- Audit and Auditors [Ch. X]

- Buy-back of Securities

- Corporate Social Responsibility [S. 135]

- Declaration and Payment of Dividend [Ch. IX]

- Exemptions to a private company under the Companies Act 2013 - at a glance

- Incorporation of company [Ch. II]

- Incorporation of company [Ch. II]

- Management and Administration [Ch. VII]

- Management and Administration [Ch. VII]

- Miscellaneous

- Miscellaneous

- Powers of the Board [Ch. XII]

- Powers of the Board [Ch. XII]

- Registration of charges [Ch. VI]

- Share capital, Debentures and Issue of securities [Ch. III, IV]

- Share capital, Debentures and Issue of securities [Ch. III, IV]

- Application of premium received on issue of shares [S. 52]

- Debentures [S. 71]

- Dematerialisation of securities [R.9, 9A]

- Issue and Redemption of Preference Shares [S. 55]

- Issue of Sweat Equity Shares [S. 54]

- Kinds of share capital [S. 43] and their voting rights [S. 47(1)]

- Power to purchase its own shares (i.e. buy-back of securities) [S. 68, R. 17]

- Private Placement vis-à-vis Preferential Offer

- Private Placement [S. 42, R.14]

- Prohibition on Issue of shares at Discount [S. 53]

- Publication of Authorised, Subscribed and paid-up capital [S. 60]

- Reduction of share capital [S. 66]

- Restrictions on purchase by the Co or giving of loans by it for purchase of its shares [S. 67]

- Types of Issue of Securities – an overview

- Some of the key SEBI compliances for listed entities

- Some of the key SEBI compliances for listed entities

- Tables

- Tables

- Contents of BoD report [S. 134(3), (3A), (5) & R.8, 8A]

- Criteria under the Co Act 2013 triggering certain compliances – At a Glance

- e Forms to be filed with RoC under Co Act 2013

- Fees to be paid to Registrar of Companies

- Illustrative list of matters requiring Special Resolution as per Co Act 2013

- Illustrative list of punishment for non-compliance/default under Co Act 2013

- Illustrative list of Statutory Registers and other records to be prepared or maintained under Co Act 2013

- Types of companies [Ch. I]

Power to purchase its own shares (i.e. buy-back of securities) [S. 68, R. 17]

|

1. |

Permissible Securities for buy-back[S. 68(1)] |

|

||||

|

2. |

Methods of buy-back [S. 68(5)] |

|

||||

|

3. |

Restrictions [S. 70] |

Buy-back not permitted:

|

||||

|

Buy-back of own shares or other specified securities |

||||||

|

4. |

Out of [S. 68(1)] |

|

||||

|

5. |

Conditions: [S. 68(2)] |

|

||||

|

6. |

Disclosures on GM notice [S. 68(3)] |

Notice of GM at which the Spl Reso is proposed to be passed for buy-back shall be accompanied by an explanatory statement giving specified disclosures. |

||||

|

7. |

Withdrawal of buy-back offer |

Not permissible once the Co has announced the offer to the SH |

||||

|

8. |

Completion of buy-back [S. 68(4)] |

Buy-back shall be completed within 1 year from the date of passing the relevant resolution |

||||

|

9. |

Declaration of solvency [S. 68(6)] |

Before making such buy-back, file a declaration of solvency signed by at least 2 directors of the Co, one of whom shall be MD, if any, verified by an affidavit (formed an opinion that the Co will not be rendered insolvent within a period of 1 year) |

||||

|

10. |

Extinguish the shares/securities bought-back [S. 68(7)] |

extinguish and physically destroy the shares or securities so bought back within 7 days of the last date of completion of buy-back |

||||

|

11. |

Subsequent buy-back [Proviso to |

Not to be made within a period of 1 year reckoned from the date of the closure of the preceding offer of buy-back |

||||

|

12. |

Restriction of further issue of same kind of shares or other securities bought-back [S. 68(8)] |

Co not to make a further issue of the same kind of shares or other securities including rights issue (u/s. 62(1)(a)) within 6 months of completion of buy-back except

|

||||

|

13. |

Some of the Filings and Records |

|

||||

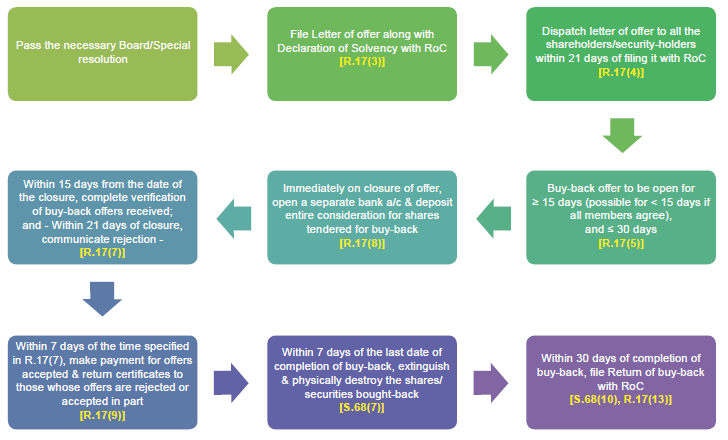

Broad overview of buy-back procedure of unlisted shares or securities