Company Law

- Abbreviations

- Acceptance of Deposits [Ch. V]

- Accounts of companies [Ch. IX]

- Accounts of companies [Ch. IX]

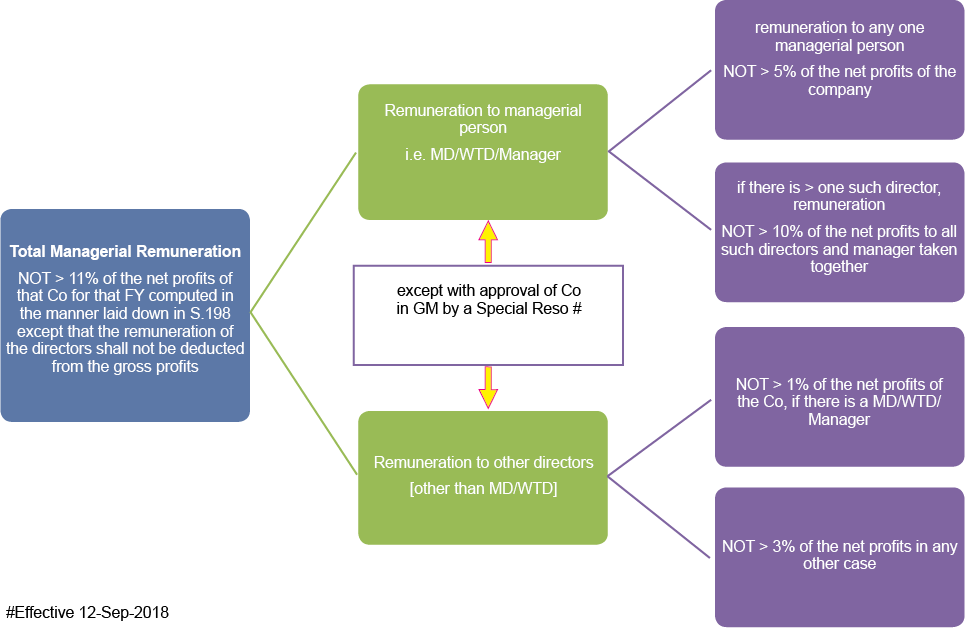

- Appointment and Remuneration to Managerial Personnel [Ch. XIII]

- Appointment and Remuneration to Managerial Personnel [Ch. XIII]

- Appointment and qualification of directors [Ch. XI]

- Appointment and qualification of directors [Ch. XI]

- Audit and Auditors [Ch. X]

- Buy-back of Securities

- Corporate Social Responsibility [S. 135]

- Declaration and Payment of Dividend [Ch. IX]

- Exemptions to a private company under the Companies Act 2013 - at a glance

- Incorporation of company [Ch. II]

- Incorporation of company [Ch. II]

- Management and Administration [Ch. VII]

- Management and Administration [Ch. VII]

- Miscellaneous

- Miscellaneous

- Powers of the Board [Ch. XII]

- Powers of the Board [Ch. XII]

- Registration of charges [Ch. VI]

- Share capital, Debentures and Issue of securities [Ch. III, IV]

- Share capital, Debentures and Issue of securities [Ch. III, IV]

- Application of premium received on issue of shares [S. 52]

- Debentures [S. 71]

- Dematerialisation of securities [R.9, 9A]

- Issue and Redemption of Preference Shares [S. 55]

- Issue of Sweat Equity Shares [S. 54]

- Kinds of share capital [S. 43] and their voting rights [S. 47(1)]

- Power to purchase its own shares (i.e. buy-back of securities) [S. 68, R. 17]

- Private Placement vis-à-vis Preferential Offer

- Private Placement [S. 42, R.14]

- Prohibition on Issue of shares at Discount [S. 53]

- Publication of Authorised, Subscribed and paid-up capital [S. 60]

- Reduction of share capital [S. 66]

- Restrictions on purchase by the Co or giving of loans by it for purchase of its shares [S. 67]

- Types of Issue of Securities – an overview

- Some of the key SEBI compliances for listed entities

- Some of the key SEBI compliances for listed entities

- Tables

- Tables

- Contents of BoD report [S. 134(3), (3A), (5) & R.8, 8A]

- Criteria under the Co Act 2013 triggering certain compliances – At a Glance

- e Forms to be filed with RoC under Co Act 2013

- Fees to be paid to Registrar of Companies

- Illustrative list of matters requiring Special Resolution as per Co Act 2013

- Illustrative list of punishment for non-compliance/default under Co Act 2013

- Illustrative list of Statutory Registers and other records to be prepared or maintained under Co Act 2013

- Types of companies [Ch. I]

Remuneration to managerial personnel

(A) Private companies

No ceiling prescribed under the Companies Act, 2013 read with the rules made thereunder. Hence the managerial remuneration should be as per the relevant provisions contained in its articles of association.

(B) Public companies having NO/INADEQUATE profits [S. 197 read with Sch V, Part II, Section II]

(i) Limits of managerial remuneration [Sch. V, Part II, Section II, (A)]

|

Effective capital of the Company |

Board approval & (ORDINARY) reso at next GM [S. 196(4)] |

Board approval & SPECIALreso |

|

|

(A) |

(B) |

||

|

From |

To |

* Yearly remuneration not exceeding |

|

|

Negative |

< ₹ 5 cr |

₹ 60 lakhs |

* Yearly remuneration exceeding the limits mentioned in the earlier column (A) |

|

₹ 5 cr |

< ₹ 100 cr |

₹ 84 lakhs |

|

|

₹ 100 cr |

< ₹ 250 cr |

₹ 120 lakhs |

|

|

₹ 250 cr and above |

₹ 120 lakhs + 0.01% of effective capital in excess of ₹ 250 cr |

||

* for a period < 1 year, the limits shall be pro-rated

(ii) Effective Capital

|

1 |

[Explanation I] |

Effective capital =

reduced by: the aggregate of -

|

||||

|

2 |

[Explanation II] |

|

||||

|

3 |

[Explanation IV] |

For the purposes of this Schedule, “negative effective capital” means the effective capital which is calculated in accordance with the provisions contained in Explanation I of this Part is < 0 |

(iii) Remuneration

|

1 |

Remuneration |

“Remuneration” means remuneration as defined in clause (78) of section 2 and includes reimbursement of any direct taxes to the managerial person. |

|

2 |

Remuneration [S. 2(78)] |

“remuneration” means any money or its equivalent given or passed to any person for services rendered by him and includes perquisites as defined under the Income-tax Act, 1961; |

|

3 |

Excluded Perquisites [Section IV of Part II, Sch. V] |

Perquisites NOT INCLUDED in managerial remuneration:

Explanation III.— For the purposes of this Schedule, ‘‘family’’ means the spouse, dependent children and dependent parents of the managerial person. |

|

4 |

Remuneration for other services [S. 197(4)] |

either by the AoA of the Co, or by a resolution or, if the AoA so require, by a special resolution, passed by the Co in GM and the remuneration payable to a director determined aforesaid shall be inclusive of the remuneration payable to him for the services rendered by him in any other capacity, unless

|

|

5 |

Sitting fees [S. 197(2), (5) & |

|

|

6 |

Manner of payment of remuneration [S. 197(6)] |

A director or manager may be paid remuneration either by way of a monthly payment or at a specified percentage of the net profits of the Co or partly by one way and partly by the other. |

|

7 |

Remuneration payable to a managerial person in two companies: [Section V] |

Subject to the provisions of sections I to IV, a managerial person shall draw remuneration from one or both companies, provided that the total remuneration drawn from the Cos does not exceed the higher maximum limit admissible from any one of the Cos of which he is a managerial person. |

(iv) Conditions [Sch. V, Part II, Section II]

|

1 |

Approval for remuneration(i) |

Payment of remuneration is approved by a resolution passed by the BoD and, in the case of a Co covered u/s. 178(1) also by the NRC; Explanation IV.— The NRC while approving the remuneration under Section II or Section III, shall—

|

|

2 |

No Default(ii) |

|

|

3 |

GM Approval (iii) |

|