FEMA and International Taxation

- Foreign Contribution (Regulation) Act, 2010

- Accounts & Audit

- All FCRA services online

- Applicability

- Change of designated bank account, name, address, aim, objects or key members of the association

- Declaration of receipts of foreign contribution

- Foreign Contribution

- Inspection & Seizure

- Introduction

- Penalty

- Registration of the Association

- Restriction on Administrative Expenses

- Restrictions on acceptance of foreign hospitality

- Restrictions on Accepting FC

- Speculative Activity

- Total Ban on acceptance of Foreign Contribution & Hospitality

- Transfer of FC to other Registered or Unregistered Persons

- Foreign Exchange Management Act, 1999

- Acquisition and transfer of Immovable property in India

- Acquisition and Transfer of Immovable Property outside India

- Bank Accounts in India

- Borrowings from Non-residents

- Branch/Liaison/Project Office in INDIA

- Branch/Liaison/Project Office outside India

- Capital & Current Account Transactions

- Compounding & Contravention under FEMA

- Cross Border Merger Regulations

- Introduction

- Investment in India

- Miscellaneous

- Overseas Direct Investments

- Residential Status under FEMA

- Trade Transactions – Import & Export

- International Taxation

Transfer Pricing

A. Substantive Provisions

- Section 92(1) provides that:

- There must be “income arising”;

- Such income must arise from an “international transaction” or a “specified domestic transaction” (“SDT”);

- Such income shall be computed having regard to the “arm’s length price” (“ALP”).

- Further, allowance for any expenses or interest arising from such transactions, or cost sharing arrangements is also to be determined having regard to ALP.

- If the application of the ALP results in reducing the chargeable income or increasing the loss from an Indian Income-tax perspective, then the Transfer Pricing Regulations shall not apply.

- The term “international transaction” is defined in section 92B. The salient features of this definition are as under :

- Use of word “means” shows that it is an exhaustive definition;

- The term “transaction” is defined in an inclusive manner in section 92F(v);

- The transaction has to be between two or more “associated enterprises” (“AEs”), which is defined in section 92A;

- At least one of the parties to the transaction must be a “non-resident”. As per section 2(30), for the purposes of section 92, the term “non-resident” includes a resident but not ordinarily resident;

- The transaction may be for purchase, sale, transfer, lease or use of tangible or intangible property, provision of services and includes -

- Cost sharing arrangement, for the allocation or apportionment of, or contribution to any cost or expense incurred in connection with a “benefit, service or facility” provided;

- Capital financing, including borrowing, lending, guarantee, purchase or sale of marketable securities, etc.; or

- Business restructuring or reorganisation, irrespective of whether it has a bearing on the profit, income, losses or assets of the enterprises at the time of the transaction or at any future date; or

- Any other transaction having a bearing on profits, income, losses or assets of the assessee.

Further, “intangible property” is defined in the Explanation to Section 92B to include intangible assets relating to marketing, technology, artistic, data processing, engineering, customer, contract, human capital, location, goodwill, etc., along with examples of each of these types of intangible assets.

- Section 92B(2) deems a transaction of the assessee with an unrelated enterprise to be an international transaction between two associated enterprises, if there exists a prior agreement between such unrelated enterprise and an AE of the assessee, irrespective of whether the unrelated party is a resident or a non-resident.

- The term “enterprise” is defined in section 92F(iii) to mean a “person” including a “permanent establishment” of a person who is, or has been or is proposed to be “engaged in” certain specified activities. Such activity or business may be carried on directly or through one or more of the units or divisions or subsidiaries, which may be located at the same place where the enterprise is located or at a different place(s).

- The term “Permanent Establishment” is defined to include a fixed place of business through which the business of the enterprise is wholly or partly carried on.

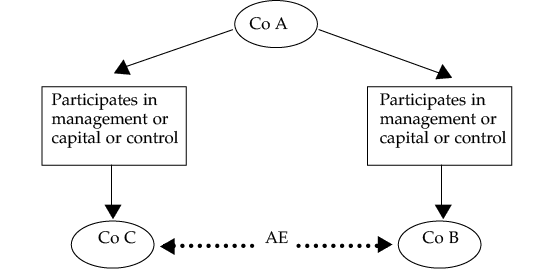

- As defined in Section 92A(1), an “enterprise” is an AE, if:

- It participates directly or indirectly in the management, control or capital of the other enterprise

|

Or,

- Any person who participates in the management, control or capital of an enterprise, also participates in the management, control or capital of the other enterprise.

|

As per Section 92A(2), in respect of the following circumstances, two enterprises shall be deemed to be AEs:

|

A holds at least 26% of the voting power of B; or |

(A & B are AEs) |

|

A holds at least 26% of the voting power of B & C; or |

(B & C are AEs) |

|

A advances a loan to B, constituting at least 51% of the book value of total assets of B; or |

(A & B are AEs) |

|

A guarantees at least 10% of the total borrowings of B; or |

(A & B are AEs) |

|

A appoints, more than half the directors of B; or one or more executive directors of B; or |

(A & B are AEs) |

|

A appoints, more than half the directors of B & C; or one or more executive directors of B & C; or |

(B & C are AEs) |

|

The manufacture or processing of goods or articles or business carried on by A is wholly dependent on the use IPRs (know-how etc.) belonging to B or in respect of which B has exclusive rights; or |

(A & B are AEs) |

|

At least 90% of the raw materials and consumables required for the manufacturing or processing of goods or articles carried out by A, are supplied by B or by persons specified by B, where the prices and other conditions relating to the supply are influenced by B; or |

(A & B are AEs) |

|

The goods manufactured or processed by A are sold to B or persons specified by B, where the prices and other conditions relating thereto are influenced by ‘B’; or |

(A & B are AEs) |

|

Where A is controlled by B (an individual) and C is controlled by B or his relative or jointly by B and his relative; or |

(A & C are AEs) |

|

Where A is controlled by B HUF, and C is controlled by a member of B HUF or by a relative of a member of B HUF or jointly by such member and his relative; or |

(A & C are AEs) |

|

Where A is a firm, AOP or BOI and B holds at least 10% interest in A; or |

(A & B are AEs) |

|

There exists any relationship of mutual interest between A and B as may be prescribed. (No relationship prescribed as yet) |

(A & B are AEs) |

Mere participation by A in the management, control or capital of B or the commonality of control, management or capital of A and B may not be sufficient to make A and B associated enterprises unless one or more of the conditions specified in the above table are satisfied.

- Section 92BA defines the term “Specified Domestic Transaction”. The salient features of this definition are as under:–

- Use of word “means” shows that it is an exhaustive definition;

- It covers the following transactions, not being international transactions, where aggregate value of such transactions exceeds ₹20 crores –

- Any transaction, referred to in section 80A or section 80-IA(8), relating to transfer of goods or services between eligible and non-eligible undertakings or units of the same entity, dealing with deductions under sections 10A, 10AA, 10B, 10BA or in any other provisions of Chapter VIA;

- Any business transacted between the assessee and any other person as referred to in section 80-IA(10);

- Any transaction referred to in any other section under Chapter VIA or section 10AA, to which the provisions of sections 80-IA(8) or 80-IA(10) are applicable;

- Any business transaction between the persons referred to in sub-section (4) of section 115BAB;

- Any other transaction as may be prescribed.

- The term “arm’s length price” is defined in section 92F(ii) to mean—

- The price which is applied or is proposed to be applied,

- In a transaction between persons other than AEs,

- In uncontrolled conditions.

- Section 92C provides the mechanism of determining the ALP by any of the following six methods:

- Comparable uncontrolled price method: (CUP)

- Comparison of price charged or paid for property transferred or services provided in a comparable uncontrolled transaction.

- Used mainly in respect of transfer of goods, provision of services, intangibles, loans, provision of finance.

- Resale price method: (RPM)

- Considers the price at which property purchased or services obtained by the enterprise from an AE is resold or are provided to an unrelated enterprise.

- Used mainly in case of distribution of finished goods or other goods involving no or little value addition.

- Cost plus method: (CPM)

- Considers direct and indirect costs of production incurred in respect of property transferred or services provided and an appropriate mark-up.

- Used mainly in respect of provision of services, joint facility arrangements, transfer of semi- finished goods, long-term buying and selling arrangements.

- Profit split method: (PSM)

- Considers combined net profit of the AEs arising from the international transaction and is split amongst them;

- Used mainly in report of transactions involving integrated services provided by more than one enterprise, transfer of unique intangibles, multiple inter-related transactions, which cannot be separately evaluated.

- Transactional net margin method: (TNMM)

- Considers net profit margin realised by the enterprise from an international transaction entered into with an AE.

- Used in respect of transactions for provision of services, distribution of finished products where resale price method cannot be adequately applied, transfer of semi-finished goods.

- Any other method as prescribed:

- “Other Method” as per Rule 10AB has been prescribed.

- Any method which takes into account the price which has been or would have been charged or paid, for similar uncontrolled transaction, under similar circumstances, considering all relevant facts.

- Comparable uncontrolled price method: (CUP)

- The most appropriate method from the above methods, taking into consideration the nature or class of the transaction, functions performed and such other factors as laid down in Rule 10B, shall be applied for determining the ALP in the manner given in Rule 10C.

- In a case where the range concept as per Rule 10CA does not apply, and the variation between the ALP determined and the transfer price does not exceed the notified percentage, then the transfer price is deemed to be the ALP.

- Application of range concept:

Where CUP, RPM, CPM or TNMM are used as most appropriate method and a dataset of at least six comparable uncontrolled transactions is obtained using any of these methods, the arm’s length range will be computed as the range beginning from the 35th percentile of the dataset (arranged in an ascending order) and ending at the 65th percentile.

The transfer price will be considered to be at ALP if it is within the arm’s length range so derived. If however, the value of the transaction is outside the aforesaid percentile range, the ALP of a transaction shall be taken to be at median or 50th percentile of the dataset.

In all the other cases where the range concept is not applicable, ALP will be determined based on the arithmetical mean.

- Use of multiple year data

Use of multiple year data has been permitted for transactions entered into after 31st March 2014. Using the notation of Y0, Y-1 and Y-2 for current year or year of transaction, the immediately preceding financial year and the financial year preceding that respectively, the provisions are as under -

|

Particulars |

Most Appropriate Method Applied |

|

|---|---|---|

|

RPM, CPM and TNMM |

CUP / PSM |

|

|

Data to be used for selection of comparable uncontrolled transactions |

If Y0 data becomes subsequently available at the time of the assessment, then such data is to be used. If Y0 data subsequently available at the time of assessment and the uncontrolled transaction for Y0 is not comparable to the controlled transaction then that entity will be excluded from the dataset of comparables even if it had carried out comparable uncontrolled transaction in Y-1 or Y-2. |

Rule 10B(5) is not clear |

|

Data to be used for computation of ALP |

|

Single year data |

|

Manner of computation of the margin as per the MAM |

Weighted average price of the comparable uncontrolled transaction for the relevant years out of Y0, Y-1 and Y-2, computed by assigning weights to the quantum of sales/cost/assets employed or the respective base depending on the MAM applied. |

Not Applicable |

- Section 92C(3) provides that an Assessing Officer (“AO”), after having provided an opportunity to the assessee of being heard, may determine the ALP, on the basis of material or information in his possession, if he is of the opinion that,

- The price charged or paid in an international transaction or SDT has not been determined in accordance with the transfer pricing provisions, or

- If any information and document relating to an international transaction or SDT has not been maintained in accordance with the provisions, or

- If the information and data used in computation of ALP is not reliable or correct, or

- If the assessee has failed to furnish, within the specified time, any information or document which he was required to furnish by a notice under section 92D(3).

Under such circumstances, the AO may recompute the total income of the assessee having regard to the ALP so determined. In such cases –

- No deduction under sections 10A, 10AA or section 10B or under Chapter VI-A is allowed in respect of the amount of addition to total income.

- The income of the AE, from which tax has been deducted or was deductible under Chapter XVIIB, shall not be recomputed by reason of such determination.

- The AO also has powers under section 92CA to refer the transactions to a Transfer Pricing Officer (TPO) with previous approval of the CIT. The TPO would then pass an order determining the ALP after hearing the assessee. Thereafter, the AO will compute the total income having regard to the ALP determined by the TPO.

The CBDT has issued revised guidelines for references to TPO, the role of TPO and related issues vide instruction No. 3/2016 dated 10th March, 2016. The guidelines inter alia provides that where the AO has not made any reference to the TPO then the determination of the ALP should not be carried out by the AO and AO should record the same in the body of the assessment order that due to the Board instructions in the matter, the transfer pricing issue has not been examined at all.

The AO while completing his assessment where a reference to the TPO was made, are bound to compute the total income of the assessee in conformity with the ALP determined by the TPO.

The TPO is empowered to determine ALP of an international transaction or SDT noticed by him in the course of transfer pricing proceedings, even where the said transaction was not referred to him or where the transfer pricing report was not furnished by the assessee. The TPO is also permitted to exercise powers of survey under section 133A of the Act.

- Secondary Adjustment:

- Section 92CE is introduced by Finance Act, 2017 with effect from AY 2018-19 to provide that where a primary adjustment to the transfer price has been made either by the assessee himself or by the AO or as per the APA or safe harbour rules or Mutual Agreement Procedure, then, the assessee shall make a secondary adjustment in his and the AE’s books of account, so to align with the transfer price determined as above. This provision is intended to remove the difference between the cash account and actual profit of the assessee.

- The above provisions shall not apply if –

- The amount of primary adjustment in any year does not exceed ₹1 crore

- The primary adjustment is in respect of AY 2016-17 or earlier.

- The excess money on account of the primary adjustment, i.e., difference between ALP and transfer price, is required to be repatriated to India within the prescribed time. If not so repatriated, it will be deemed to be advance made by the assessee to its AE and interest shall be computed on the same in the prescribed manner.

Following amendments made by Finance Act, 2019

Secondary adjustment provisions rationalised

- The secondary adjustment provision has been amended for its effective implementation. The amendment clarifies that the provisions will apply only from FY16-17 and only if the primary adjustment is INR 10 million or more.

- Both retrospective and prospective amendments was proposed in this provision.

- The retrospective amendments proposed from assessment year 2018-19 are as follows:

- The provisions of secondary adjustment will apply only on those APAs that are signed on or after 1 April 2017. However, if any tax refund arises on giving effect to the proposed retrospective amendment, such refund will not be granted.

- Cash repatriation can be made either in full or in part.

- Cash repatriation can be made from any AE that is a non-resident in India.

The prospective amendments effective from 1 September 2019 are as follows:

- Assessees have been given an option to pay a one-time additional tax of 18 percent on the excess money or part thereof, in case cash is not repatriated in India within the prescribed time limit.

- No tax credit or tax deduction for such additional tax will be available to the taxpayer or any other person.

- Notional interest under the secondary adjustment will not apply from the date of payment of additional tax.

- Safe Harbour Rules:

Section 92CB provides for the determination of ALP subject to safe harbour rules. Safe harbour is defined to mean circumstances in which the Income-tax authorities shall accept the transfer price declared by the assessee. Rules 10TA to 10TG contain the procedure for adopting the safe harbour, conditions to be met for eligibility, the transfer price to be adopted, the compliance procedure etc. The prescribed safe harbour margin/price, based on which the transfer price declared by an eligible assessee shall be accepted by the TPO.

Safe harbour rules to cover determination of profit attributable to a PE

- The safe harbor rules [under section 92CB read with Rule 10TA to 10TF] have been proposed to be expanded to cover profits attributable [under section 9(1)(i) of the Act] to a PE. This will be applicable for AY 2020–21, and subsequent assessment years.

- The term “safe harbor” has been expanded to include the income-tax authorities shall accept the transfer price or income, deemed to accrue or arise under section 9(1)(i), as the case may be, declared by the assessee.

- The above consequential amended made in the explanation to section 92CB(2).

- Section 94A, inter alia, provides that if an assessee enters into a transaction where one of the parties to the transaction is a person located in a “notified jurisdictional area” then all the parties to the transaction to be deemed to be AE and any transaction entered into with them to be regarded as an international transaction and transfer pricing provisions to apply accordingly.

- Limitation of interest deduction:

Section 94B has been introduced by Finance Act, 2017 with effect from AY 2018-19 to limit the deduction of interest in certain cases.

- Where an Indian company or Permanent Establishment (“PE”) of a foreign company in India borrows from its AE and incurs interest or similar payment exceeding ₹1 crore on the same, which is deductible in computing income under the head “Profits and Gains from Business or Profession”, and total interest paid or payable by the borrower exceeds 30% of its EBITDA, then such excess or the interest paid or payable to the AE, whichever is lower, shall be disallowed.

- Where debt is issued by a third party lender against implicit or explicit guarantee or deposit provided by the AE, such debt shall be deemed to be issued by the AE.

- Excess interest disallowed in a particular year can be carried forward for a period of 8 assessment years immediately succeeding the first assessment year in which it was computed, and allowed as a deduction against the business profits, subject to the limit of maximum allowable interest of 30% of EBITDA.

- These provisions shall not apply to an entity engaged in the business of banking or insurance.

- Further, in a situation –

- where the borrower is an Indian company/ Indian PE of a NR company and

- lender is the Indian PE of a non-resident engaged in the business of banking,

- then the provisions of deemed AE (and consequently the disallowance of interest deduction) under section 94B will not apply.

B. Procedural Provisions

- Section 92D provides that every person who has entered into an “international transaction” or SDT shall keep and maintain the prescribed information and documents which shall be maintained for the prescribed period of 8 years from the end of the assessment year (“AY”).

- With effect from AY 2017-18, any person, being a constituent entity of an international group, shall also keep and maintain such information and documents in respect of an international group as may be prescribed. Section 92D read with section 286 provides for the requirement to furnish a country-by-country report to the prescribed Income-tax authority in such manner and form that will be prescribed. No rules in this regard have been prescribed so far.

In the Finance Act, 2018, the following amendments were made in CbCr with a view to improve the effectiveness and reduce the compliance burden of such reporting:

The time allowed to the parent entity or Alternate Reporting Entity (ARE), which is resident in India, for furnishing the CbCr is now proposed to be extended to twelve months from the end of reporting accounting year. The accounting year in respect of which the financial and operational results are required to be reflected in the report.

The Constituent entity of an MNE group, which is resident in India, having a non-resident parent shall also furnish CbCr in case its parent entity outside India has no obligation to file the CbCr report in the latter’s country or territory;

The time allowed for furnishing the CbCr, in the case of constituent entity resident in India, having a non-resident parent shall be twelve months from the end of reporting accounting year

The due date for furnishing of CbCr by the ARE of an international group whose parent entity is outside India will be the due date specified by that country or territory. ARE must furnish the CbCr with the tax authority of the country or territory of which it is resident

The abovementioned amendments would apply retrospectively with effect from 1st April 2017 (AY 2017-18)

Due date of CbCR clarified for ARE

It has been clarified with retrospective effect from assessment year 2017-18 that in case of an ARE resident in India, the due date of filing CbCR by the ARE in India

will be 12 months from the end of the accounting year

of the ultimate parent entity, which is not a resident in India.“Where the Country-by-Country Report (CbCr) must be filed?”

CbCr are generally to be filed where the headquarter of the parent company exists. However, if the country where the headquarter of the parent company exists has not implemented CbCr, MNEs should file CbCr in the country where their most significant activities occur and

where CbCr is implemented. This is to be made available to tax authorities in all jurisdictions in which the MNE operates.CbCr will give tax administrations a global picture of the operations of MNE Groups. CbCr might be a tough task, but it can provide the tax authorities information to perform high level transfer pricing risk assessments and to evaluate other BEPS-related risks. Therefore, MNE Groups should now adopt a consistent and harmonised approach for preparing their master file and local files as well as CbC reporting and be prepared for a more detailed information or document requests during an audit.

Master file to be filed by every constituent entity

- Transfer pricing documentation provisions have been proposed to be amended to provide that every constituent entity of an international group will be required to file a master file even when there is no international transaction undertaken by such constituent entity.

- The assessing officer or CIT(A) cannot obtain master file from the taxpayer.

- The AO/CIT may require an assessee, in the course of any proceedings under the Act, to furnish the prescribed information or documents within 30 days from date of receipt of the notice, extendable by a further period of

30 days at the discretion of the AO/CIT. - Every person who has entered into an international transaction is required to obtain an accountant’s report in Form 3CEB one month prior to the due date for filing of return of income, i.e., October 31.

- The time limit for passing orders by the AO where a reference is made to the TPO for determining the ALP is as under:

|

Particulars |

Time limit |

|---|---|

|

In respect of normal assessment |

For assessments relating to AY 2018-19 – 30 months from the end of the AY For assessments relating to AY 2019-20 and subsequent years – 24 months from the end of the AY |

|

In case of reopened assessments |

For notice served on or after 1-4-2019: 24 months from the end of the FY in which notice under section 148 is served. |

|

In case of order under sections 254, 263, 264 |

For order received or passed, as the case may be, on or after 1-4-2019: 24 months from the end of FY in which the order under sections 254, 263 or 264 is received or passed, as the case may be, by the concerned authority |

|

In case of search or requisition cases |

For assessments relating to AY 2018-19 – 30 months from the end of the FY in which the last authorisation for search or requisition was executed. For assessments relating to AY 2019-20 and subsequent years – 24 months from the end of the FY in which the last authorisation for search or requisition was executed. |

C. Advance Pricing Agreement (APA)

Sections 92CC and 92CD provide for a framework for Advance Pricing Agreement (APA). The salient features of the APA mechanism inter alia include the following :-

- CBDT can enter into any APA, for determination of the ALP or specifying the manner in which ALP is to be determined, with any person undertaking or contemplating to undertake an international transaction.

- The manner of determination of ALP in such cases shall be any method as prescribed under Rule 10C with necessary adjustments or variations.

- The ALP of any international transaction, which is covered under such APA, shall be determined in accordance with the APA.

- The APA will be valid for such previous years as specified in the agreement, but not exceeding five consecutive previous years.

- The APA will be binding only on the person and the Commissioner (including Income Tax authorities subordinate to him) in respect of the transaction in relation to which the agreement has been entered into.

- The APA will not be binding if there is any change in law or facts having bearing on such APA.

- CBDT can declare, with the approval of Central Government, any APA as void ab initio, if it finds that the APA has been obtained by fraud or misrepresentation of facts.

- For the purpose of computing any limitation period the period beginning with the date of such APA and ending on the date of order declaring the agreement void ab initioto be excluded. However, if after the exclusion of the aforesaid period, the period of limitation referred to in any provision of the Act is less than sixty days, such remaining period to be extended to sixty days.

- Rules 10F to 10T and Rule 44GA prescribe the manner, form, procedure and any other matter generally in respect of the APA.

- If an application is made by a person for entering into such an APA, all assessment proceedings shall be deemed to be pending in case of such a person.

- Where a person who has entered into an APA and prior to entering into an APA has furnished a return of income for the previous year to which the APA applies, such person is required to furnish a modified return within a period of three months from the end of the month in which the said APA was entered.

- If the assessment or reassessment proceedings for an assessment year to which the APA applies are pending on the date of filing of modified return, the AO shall proceed to complete the proceedings in accordance with the APA taking into consideration the modified return so filed. The period of limitation of completion of proceedings in such case to be extended by one year.

- If the assessment or reassessment proceedings for an assessment year to which the APA applies have been completed before the expiry of period allowed for furnishing of modified return, and a modified return is filed, the AO can assess or reassess or recompute the total income in accordance with the APA. The period of limitation for completion of such assessment or reassessment to be one year from the end of the financial year in which the modified return is furnished.

- Rollback mechanism:

The APA may also apply to previous years preceding the first previous year for which the APA applies as per the rollback mechanism. Salient features of the mechanism are:-

- Definition of “rollback year” to mean any previous year, falling within the period not exceeding four previous years, preceding the first of the previous year covered by APA.

- The international transaction must be the same as the international transaction to which the agreement (other than the rollback provision) applies.

- The return of income along with Form 3CEB for the relevant rollback years have been furnished by the applicant before the due date.

- The applicant has requested for applicability of rollback provision for all rollback years in which said international transaction has been undertaken, in Form 3CEDA along with a fee of ₹50 lakhs.

- The rollback provision shall not be provided for a rollback year if

- The determination of ALP of the said international transaction for the said year has been subject matter of an appeal before the Appellate Tribunal and the Appellate Tribunal has passed an order disposing of such appeal at any time before signing of the agreement;

- The application of rollback provision has the effect of reducing the total income or increasing the loss, as the case may be, of the applicant as declared in the return of income of the said year.

- Summary of the rules pertaining to the APA Scheme are as under:

- Unilateral, bilateral and multilateral APAs may be entered into.

- For unilateral APA, application will have to be filed with the Director General of Income Tax (International Taxation), for bilateral and multilateral APA, application to be filed with the Competent Authority.

- Application for pre-filing consultation can be made in Form 3CEC to the DGIT. An anonymous pre-filing can be done where the name of the applicant assessee need not be given. However, the name of the authorised representative appearing on behalf of the assessee will have to be given.

- After conclusion of the hearing of pre-filing application, the assessee if it so desires may file the final APA application. The final APA application is to be filed in Form 3CED along with payment of the fees.

- The hearing of the APA is a continuous process and involves site visit at the premises of the applicant.

- In respect of one time transaction, APA can be filed before undertaking the transaction. However, in case of transaction of a continuing nature it shall be filed before the first day of the previous year relevant to the first assessment year for which the application is made.

- The applicant may withdraw the application of the APA in Form 3CEE at any time before the finalisation of terms of the APA. No refund of the fees will be granted in such cases.

- The APA will be entered into by the CBDT with the assessee after approval from the Central Government.

- The APA may be revised if –

- There is a change in the critical assumptions or failure to meet the conditions contained in the APA;

- There is a change in the law that modifies any matter covered in the APA but is not of a nature which renders the APA to be non-binding;

- The assessee who has entered into an APA is required to file an annual compliance report to the DGIT in Form 3CEF within 30 days of the due date of filing the income tax return for that year or within 90 days of entering into the APA whichever is later. The DGIT shall forward the copy to the CIT and the TPO having jurisdiction over the assessee.

- The TPO will carry out a compliance audit for each year covered in the agreement. The time limit for completion of the same is 6 months from the end of the month in which the annual compliance report is filed.

- The APA may be cancelled if –

- The compliance audit has resulted in finding of failure on part of the assessee to comply with the terms of the APA, or

- There is failure to file the annual compliance report in time, or

- Annual compliance report contains material errors, or

- Assessee does not agree to the revision of the APA

- For bilateral and multilateral APAs, the AE would be required to initiate the APA process in the other country.

APA provisions to cover determination of profit attributable to a PE

- It is proposed to expand the scope of the Advance Pricing Agreement (APA) provisions to include determination of profit attributable [under section 9(1)(i) of the Act] to a Permanent Establishment (PE). The benefit of the rollback can also be availed by such PEs.

- The provisions will apply to an APA entered into on, or, after 1 April 2020.

Assessment order giving effect to APA

In case of years covered under the APA, for which the assessment or reassessment has been completed by the due date of modified return, it is proposed to restrict the powers of the assessing officer to modify the assessment order only to give effect to the terms of the APA.

D. Penal Provisions

1. Section 269SU

- To promote the digital economy, and curb generation and circulation of black money, a new section is proposed to be inserted to provide that every person, carrying on business whose total sales, turnover, or gross receipts, in business exceeds INR 500 million during the immediately preceding previous year, shall provide a facility for accepting payment through prescribed electronic modes, in addition to the facility for other electronic modes of payment, if any presently being provided.

- Section 271DB has been introduced to provide for a penalty of INR 5,000 for every day during which the failure to provide the facility for electronic modes of payment prescribed under section 269SU continues.

- However, no such penalty shall be imposed if the person proves that there were good and sufficient reasons for the failure.

2. Section 271(1)(c)

As per Explanation 7 to section 271(1)(c),

- In case of an assessee who has entered into an international transaction or SDT,

- If any amount is added or disallowed under section 92C(4),

- Then the amount so added or disallowed shall be deemed to be income in respect of which particulars have been concealed or inaccurate particulars have been furnished

- Unless the assessee proves to the satisfaction of the AO or the Commissioner (Appeals) or the Commissioner that the price charged or paid in such transaction was computed as per section 92C, in good faith and with due diligence.

The amount of penalty provided for is 100% to 300% of the tax sought to be evaded.

The provisions of section 271(1)(c) shall not apply from AY 2017-18.

3. Section 270A

Section 270A is applicable with effect from AY 2017-18 for levy of penalty in cases of under-reporting and misreporting of income.

However, failure to report any international transaction or deemed international transaction or SDT shall be regarded as a case of misreporting of income.

The penalty leviable is as under:

|

Under-reporting of income |

50% of tax payable |

|

Under-reporting of income results from misreporting of income |

200% of tax payable |

The section provides for grant of immunity from imposition of penalty and initiation of prosecution proceedings, on an application being made to the AO, if tax and interest payable based on the assessed income has been paid within specified period and no appeal has been preferred. However, no such immunity is available in case of misreporting of income.

The section now provides for levy of penalty in such a case where a return of income has been filed for the first time in response to a notice under section 148. In such a case, if the income assessed is greater than the maximum amount, which is not chargeable to tax, then it will be considered that he has under reported his income.

In such a case, the amount of under-reported income shall be computed in the following manner:

- In case of a company, firm or local authority, the assessed income itself would be considered as under-reported income.

- In other case, the excess of assessed income over the maximum amount not chargeable to tax would be considered as under-reported income.

This amendment is applicable retrospectively with effect from 1 April 2017 and will accordingly apply from AY 2017-18.

4. Section 271AA

If the assessee –

- Fails to keep and maintain the prescribed information and documents or;

- Fails to report any international transaction which is required to be reported, or;

- Maintains or furnishes any incorrect information or documents.

Penalty equal to 2% of the value of the transaction may be levied for each failure.

5. Section 271AAD

A new section 271AAD has been inserted to provide that if during any proceeding under the Act, either a false entry or an omission of any entry which is relevant for computation of total income of such person is found in the books of account maintained by any person with a view to evade tax liability, the Assessing Officer may levy a penalty a sum equal to the aggregate amount of such false or omitted entry. Definition of “false entry” includes use or intention to use–

- forged or falsified documents such as a false invoice or, in general, a false piece of documentary evidence; or

- invoice in respect of supply or receipt of goods or services or both issued by the person or any other person without actual supply or receipt of such goods or services or both;

or - invoice in respect of supply or receipt of goods or services or both to or from a person who does not exist.

This amendment will take effect from 1st April, 2020.

6. Section 271BA

Failure to furnish the accountant’s report may attract penalty of ₹ 1,00,000/-.

7. Section 271FAA

- Section 271FAA imposes a penalty of INR 50,000 on filing inaccurate details in the statement, by prescribed reporting financial institution.

- It is proposed to amend the penalty provisions to extend it to all persons responsible for filing the said statement under Section 285BA.

The above-mentioned amendments will take effect from 1 September 2019.

8. Section 271G

Failure to furnish the required information and documents may attract penalty of 2% of the value of the transaction for each failure. The power to levy this penalty has also been conferred on the TPO.

9. Section 273B

The penalties u/ss. 271AA, 271BA and 271G may not be levied if the assessee establishes reasonable cause for the said failures.

10. Section 276CC

The provisions of section 276CC currently provides for prosecution in case of willful failure to furnish return of income in due time. Immunity from prosecution is granted inter alia where the tax payable, as reduced by the advance tax and tax deducted at source does not exceed INR 3,000 in respect of persons (other than companies). The present provisions do not provide for reduction of self-assessment tax paid or tax collected at source while determining the tax payable.

- To clarify the legislative intent, it is proposed to amend the said section to include the self-assessment tax, if any, paid before the expiry of the assessment year, and tax collected at source for the purpose of determining tax liability.

- Further, to rationalise the existing threshold limit of tax payable, it is further proposed to amend the said section to increase the threshold of tax payable from INR 3,000 to INR 10,000.

E. Transfer Pricing Rules

The Central Government has notified rules for giving effect to the provisions of sections 92C, 92D and 92E of the Act.

The gist of the said rules, to the extent not already discussed above, is as under:

- Rule 10A defines terms used in the rules for determining ALP, i.e., uncontrolled transaction, property, services and transaction.

- Rule 10B(1) elaborates the manner of determining ALP under each of the methods described in section 92C(1).

- Rule 10B(2) lays down parameters to be considered in comparing an international transaction or a SDT with an uncontrolled transaction, i.e.,

- Contractual terms

- Specific characteristics of property transferred or services provided

- Functions performed, risk assumed and assets employed

- Market conditions, which may include location and size of market, government regulations in force, level of competition, etc.

- Rule 10B(3) provides for adjustment to eliminate material differences between an international transaction and an uncontrolled transaction, affecting the prices.

- Rule 10B(4) provides that for the purpose of comparing international transaction and uncontrolled transaction the data for the relevant financial year or immediately preceding two years be used. However, in respect of transactions entered into after 31st March 2014, multiple year data is permitted to be used as described in point A.14 above.

- Rule 10C recognises that there cannot be a single method which may be appropriate under all circumstances. It lays down various factors to be considered for determining the most appropriate method in a particular international transaction.

- Rules 10D(1) and 10D(3) prescribe that the information and documents required to be maintained by every person who has entered into international transaction, supported by authentic documents.

- Rule 10D(2) grants exemption from maintaining prescribed information and documents, if the aggregate value of international transactions, as recorded in the books of account, does not exceed ₹1 crore.

- Rule 10D(2A) lays down the minimum documents to be maintained by an assessee opting for safe harbour rules.

- Rule 10D(4) requires that the information and documents be contemporaneous.