FEMA and International Taxation

- Foreign Contribution (Regulation) Act, 2010

- Accounts & Audit

- All FCRA services online

- Applicability

- Change of designated bank account, name, address, aim, objects or key members of the association

- Declaration of receipts of foreign contribution

- Foreign Contribution

- Inspection & Seizure

- Introduction

- Penalty

- Registration of the Association

- Restriction on Administrative Expenses

- Restrictions on acceptance of foreign hospitality

- Restrictions on Accepting FC

- Speculative Activity

- Total Ban on acceptance of Foreign Contribution & Hospitality

- Transfer of FC to other Registered or Unregistered Persons

- Foreign Exchange Management Act, 1999

- Acquisition and transfer of Immovable property in India

- Acquisition and Transfer of Immovable Property outside India

- Bank Accounts in India

- Borrowings from Non-residents

- Branch/Liaison/Project Office in INDIA

- Branch/Liaison/Project Office outside India

- Capital & Current Account Transactions

- Compounding & Contravention under FEMA

- Cross Border Merger Regulations

- Introduction

- Investment in India

- Miscellaneous

- Overseas Direct Investments

- Residential Status under FEMA

- Trade Transactions – Import & Export

- International Taxation

Bank Accounts in India

Non-residents have been allowed to maintain Bank accounts in India, both in INR and foreign currency. There are basically 3 types of accounts that can be maintained in India by a Person Resident outside India:

- Non Resident (Ordinary) Account – NRO A/c

- Non Resident (External) Rupee Account – NRE A/c

- Non Resident (Foreign Currency) Account – FCNR A/c

|

Particulars |

NRO A/c |

NRE A/c |

FCNR A/c |

|---|---|---|---|

|

Who can open an account |

Any person resident outside India (Individuals/Entities of Bangladesh /Pakistan nationality/ownership require RBI approval) |

NRIs & PIOs (Individuals/ entities of Bangladesh / Pakistan nationality/ownership require RBI approval) |

NRIs & PIOs (Individuals/entities of Bangladesh/Pakistan nationality/ownership require RBI approval) |

|

Currency |

INR |

INR |

Permissible Foreign Currency |

|

Repatriable/ |

Non-Repatriable (Except current income and by NRI/PIO under USD 1 million per F.Y. scheme) |

Repatriable |

Repatriable |

|

Type of Account |

Current, Savings, Recurring or Fixed Deposit Accounts |

Current, Savings, Recurring or Fixed Deposit Accounts |

Term Deposits |

|

Joint accounts |

Jointly with residents on ‘former or survivor’ basis. NRIs and/or PIOs may hold NRO accounts jointly with other NRIs and/or PIOs. |

In names of two or more NRI/ PIOs or with resident relative(s) on “former or survivor” basis. |

In names of two or more NRI/PIOs or with resident relative(s) on “former or survivor” basis. |

|

Major Permissible Debits |

Local rupee payments, Transfer to other NRO A/c, remittance outside India of current income in India (net of taxes) |

Local disbursements, remittance outside India, transfer to other NRE/FCNR account and Investment in India |

Local disbursements, remittance outside India, transfer to other NRE/FCNR account and investment in India |

|

Major Permissible Credits |

Remittance in permitted foreign currency, Deposit by Account holder during temporary visit to India, Transfer from other NRO A/c, dues in India of Account Holder, Rupee loans/gift from resident relative under LRS etc. |

Remittance in permitted foreign currency, proceeds of foreign currency/bank notes tendered during temporary visit to India, transfer from other NRE / FCNR account, Current Income, interest on bank balances & investments. |

Remittance in permitted foreign currency, proceeds of foreign currency/bank notes tendered during temporary visit to India, transfer from other NRE/FCNR account, current income, interest on bank balances & investments. |

|

Taxability of Interest |

Taxable |

Non-Taxable |

Non-Taxable |

Even residents have been allowed to maintain foreign currency accounts in India as under:

i. EEFC Account

A person is permitted to credit the under-mentioned amounts out of his foreign exchange earnings to his Exchange Earners Foreign Currency (EEFC) Account:

|

Entity or person |

Limit in % |

|

|---|---|---|

|

1. |

Status Holder Exporter (as defined in the EXIM Policy in force) |

100 |

|

2. |

Individual professionals ** |

100 |

|

3. |

100% EOU Unit in EPZ/STP/EHTP |

100 |

|

4. |

Any other person |

100 |

** Professionals mean Director on Board of overseas company; Scientist/Professor in Indian University/Institution; Economist/ Lawyer/Doctor/Architect/ Engineer/Artist/Cost/Chartered Accountant/ Any other person rendering professional services in his individual capacity, as may be specified by the Reserve Bank from time-to-time. Professional earnings including director’s fees, consultancy fees, lecture fees, honorarium and similar other earnings received by a professional by rendering services in his individual capacity.

However, amounts received to meet specific obligations of the account holder cannot be credited (e.g., equity investment from a non-resident investor). The balances do not earn any interest.

These funds can be used for several current account purposes. For many transactions, where there are restrictions under the current account rules, funds in EEFC account can be used without restrictions. However, EEFC account holders are permitted to purchase foreign exchange only after utilising fully the available balances in the EEFC accounts.

Individuals can open EEFC account jointly with any of their ‘close relative’ on ‘former or survivor basis’ but the joint relative cannot operate the account.

Units in SEZ are permitted to open, hold and maintain a Foreign Currency Account with an authorised dealer in India.

ii. Resident Foreign Currency (Domestic) Account – RFC (D) A/c

A person resident in India can open, hold and maintain a Resident Foreign Currency (Domestic) Account and credit the account with foreign exchange in the form of currency notes, bank notes and travellers cheques from the following sources:

- Payment/ service/ gift/ honorarium received while on visit abroad or from a non-resident who is on a visit to India

- Unspent amount of foreign exchange acquired from AD for travel abroad

- Amount received as Gift from close relative

- Earning through export of goods/ services, royalty

- Disinvestment proceed on conversion of shares into ADR/ GDR

- Proceeds of insurance policies settled in foreign currency that is issued by Insurance Companies in India.

iii. Resident Foreign Currency Account – RFC A/c

Resident Indians can also open RFC account. This account is different from RFC (D) account. This account is primarily for non-residents who return to India. In RFC A/c., following items can be deposited:

- Pension or any other superannuation or other monetary benefits from employer outside India.

- Amount received on conversion of the assets if those assets were acquired when such person was a non-resident.

- Amount received as gift or inheritance from a person who was a non-resident and has become a resident.

- Proceeds of insurance policies settled in foreign currency that is issued by Insurance Companies in India.

There are no restrictions on use of funds. They can be used for meeting expenses and making investments abroad. RFC account can be maintained in the form of current or savings or term deposit accounts.

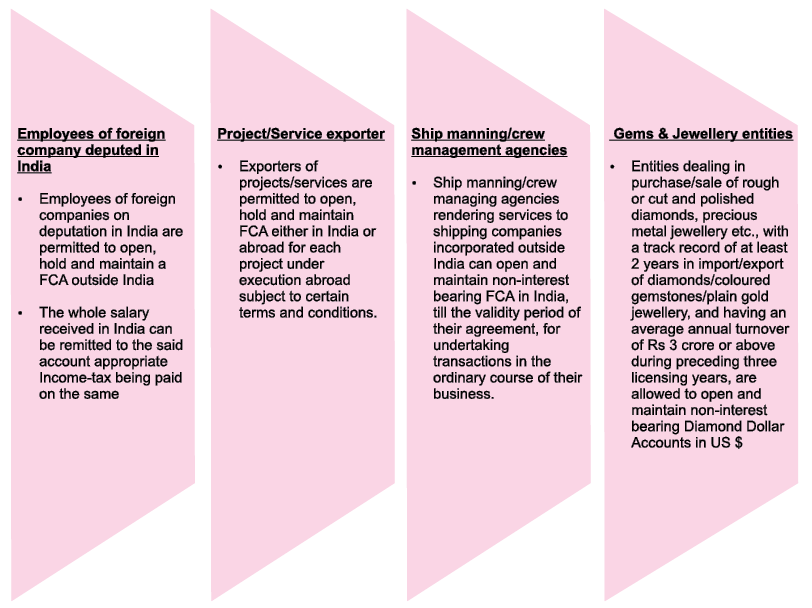

Other Foreign Currency Accounts by Specific Persons

Any passenger bringing in foreign exchange on his arrival in India in the form of currency notes, bank notes or travellers cheques exceeding US $ 10,000 or its equivalent and / or the value of foreign currency notes exceeding US $ 5,000 or its equivalent is required to file a declaration in Form CDF with the Custom Authorities. A person resident in India is permitted to carry only ₹ 25,000/- during his visit abroad (except Nepal and Bhutan).

Temporary Foreign Currency Accounts In India

Organisers of International Seminars, Conferences, Conventions, etc., who have been permitted by the concerned Administrative Ministry of the Government of India to hold such seminars, etc. are permitted to open temporary foreign currency accounts in India. The account is to be operated for receipt of delegate fees from abroad and payment of expenses including payment to special invitees from abroad. The said account has to be closed immediately after the conference/event is over.