Company Law

- Abbreviations

- Acceptance of Deposits [Ch. V]

- Accounts of companies [Ch. IX]

- Appointment and Remuneration to Managerial Personnel [Ch. XIII]

- Appointment and qualification of directors [Ch. XI]

- Audit and Auditors [Ch. X]

- Buy-back of Securities

- Corporate Social Responsibility [S. 135]

- Declaration and Payment of Dividend [Ch. IX]

- Exemptions to a private company under the Companies Act 2013 - at a glance

- Incorporation of company [Ch. II]

- Management and Administration [Ch. VII]

- Miscellaneous

- Powers of the Board [Ch. XII]

- Registration of charges [Ch. VI]

- Share capital, Debentures and Issue of securities [Ch. III, IV]

- Application of premium received on issue of shares [S. 52]

- Debentures [S. 71]

- Dematerialisation of securities [R.9, 9A]

- Issue and Redemption of Preference Shares [S. 55]

- Issue of Sweat Equity Shares [S. 54]

- Kinds of share capital [S. 43] and their voting rights [S. 47(1)]

- Power to purchase its own shares (i.e. buy-back of securities) [S. 68, R. 17]

- Private Placement vis-à-vis Preferential Offer

- Private Placement [S. 42, R.14]

- Prohibition on Issue of shares at Discount [S. 53]

- Publication of Authorised, Subscribed and paid-up capital [S. 60]

- Reduction of share capital [S. 66]

- Restrictions on purchase by the Co or giving of loans by it for purchase of its shares [S. 67]

- Types of Issue of Securities – an overview

- Some of the key SEBI compliances for listed entities

- Conditions to be complied with upon resignation of the statutory auditor of a listed entity / material subsidiary w.r.t. limited review / audit report [SEBI CIRCULAR CIR/CFD/CMD1/114/2019 dated 18-Oct-2019]

- Corporate Governance under LODR [Ch. III of LODR]

- Illustrative Compliance calendar under LODR for Entities which has listed its specified securities

- Publishing Quarterly/Half Yearly/Annual Results by Listed Companies under LODR

- Tables

- Contents of BoD report [S. 134(3), (3A), (5) & R.8, 8A]

- Criteria under the Co Act 2013 triggering certain compliances – At a Glance

- e Forms to be filed with RoC under Co Act 2013

- Fees to be paid to Registrar of Companies

- Illustrative list of matters requiring Special Resolution as per Co Act 2013

- Illustrative list of punishment for non-compliance/default under Co Act 2013

- Illustrative list of Statutory Registers and other records to be prepared or maintained under Co Act 2013

- Types of companies [Ch. I]

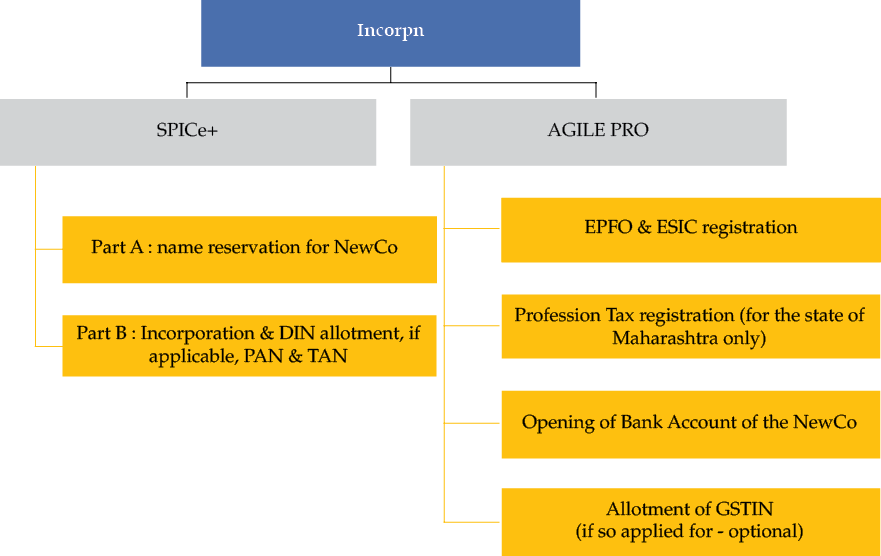

Procedure for Incorporation of a NewCo:

As part of Government of India’s Ease of Doing Business initiatives, MCA has, effective 23-Feb-2020, notified new integrated Web Forms christened ‘SPICe+’ and ‘AGILE Pro’ replacing the existing ‘SPICe’ and ‘AGILE’.

Introduction of new forms:

|

|

SPICe+ : |

|

|

|

Part A |

similar to RUN for name reservation for NewCo |

|

|

Part B |

Similar to earlier SPICe |

|

|

|

|

|

|

|

|

AGILE-PRO (Application for GSTIN, ESIC & EPFO registration, Profession tax registration for Maharashtra and Opening of bank account) |

|

|

|

|

|

|

|

|

|

|

|

Incorporation process initiated BEFORE 23-Feb-2020 i.e. name application / incorporation application filed before 23-Feb-2020 ⟶ Submit/ resubmit, as the case may be, in eForm SPICe along with AGILE

Incorporation process initiated AFTER 23-Feb-2020

Alternative 1:

|

file web based Part A of Form SPICe+ |

⟶ |

reservation / approval of name of the NewCo |

⟶ |

File Part B of SPICe+ alongwith AGILE Pro The approved name and related incorporation details as submitted in Part A of SPICe+, would be automatically Pre-filled in all linked forms also viz., AGILE-PRO, eMoA, eAoA, URC-1, INC-9 (as applicable) |

Alternative 2:

|

file web based Part A as well as Part B of Form SPICe+alongwithAGILE Pro |

The basic documents for incorporation have remained unchanged (given below). MCA has attempted to explain / clarify host of queries through help kits and FAQs. It is advisable to thoroughly go through the eForms, their respective help kits (accessible only after MCA login, under ‘MCA Services’ -> ‘SPICe+’), as well as FAQs (accessible without MCA login) on MCA portal for guidance on any incorporation related matter as these are very dynamic at the moment.

Procedure for Incorporation of a NewCo is summarized below:

|

1. |

Reservation of name of NewCo [Not mandatory] [S. 4(4), (5), R.9] |

|

||||||||||

|

2. |

Name of the NewCo {Please also refer Special measures incl. Key CoVID 19 effects} |

The name of the proposed NewCo should not -

|

||||||||||

|

3. |

Memorandum and Articles of Association of the NewCo [S. 6, S. 7(1)(a), R.13] |

|

||||||||||

|

||||||||||||

|

• If subscriber is a foreign national residing outside India:-

|

||||||||||||

|

4. |

Declaration by a practicing professional and by a first director/manager/secretary of the NewCo [S. 7(1)(b), R.14] |

Declaration by a practicing professional (advocate/CA/cost accountant/CS) who is engaged in the formation of the NewCo - that all the requirements of Co Act and the rules made thereunder in respect of registration and matters precedent or incidental thereto have been complied with (This forms part of the eForm itself, certified by the professional and hence no separate declaration required) |

||||||||||

|

5. |

Declaration from each of the subscribers and first directors |

Declaration from each of the subscribers and first directors in Form No. INC 9, stating that he is not convicted of any offence in connection with the promotion, formation or management of any company, or that he has not been found guilty of any fraud or misfeasance or of any breach of duty to any company under Co Act or any previous company law during the preceding 5 years and that all the documents filed with the Registrar for registration of the company contain information that is correct and complete and true to the best of his knowledge and belief INC-9 shall be auto-generated in pdf format and would have to be submitted only in electronic form in all cases, except where: (i) Total number of subscribers and/or directors is > 20 and/or (ii) Any such subscribers and/or directors has neither DIN nor PAN |

||||||||||

|

6. |

Particulars of every subscriber along with proofs [S. 7(1)(e), R.16] |

I. Particulars of every (individual) subscriber to be filed at the time of incorporation of NewCo: (a) Name (including surname or family name) and recent Photograph affixed and scan with MOA and AOA; (b) Father’s/Mother’s/name; (c) Nationality; (d) Date of Birth; (e) Place of Birth (District and State); (f) Educational qualification; (g) Occupation; (h) Income-tax PAN; |

||||||||||

|

(i) Permanent residential address and also Present address (Time since residing at present address and address of previous residence address (es) if stay of present address is < 1 year), Similarly the office/business addresses; (j) Email id of Subscriber; (k) Phone No. of Subscriber; (l) Fax no. of Subscriber (optional) Information related to (i) to (l) shall be of the individual subscriber and not of the professional engaged in the incorporation of the NewCo; |

||||||||||||

|

(m) Documents

|

||||||||||||

|

(p) If the subscriber is already a director or promoter of a company(s), the particulars relating to -

|

||||||||||||

|

II. Particulars of every (body corporate) subscriber to be filed at the time of incorporation of NewCo:

|

||||||||||||

|

(h) the subscribers’ particulars as specified at I. above for the person subscribing for body corporate; |

||||||||||||

|

(i) in case of foreign bodies corporate, the details/documents relating to -

|

||||||||||||

|

7. |

Particulars of each of the first directors [S. 7(1)(f), (g), R.17] |

Particulars of each of the first directors of NewCo, his interest in other firms or bodies corporate along with his consent to act as director of NewCo |

||||||||||

|

8. |

Registered office address [S. 7(1)(d), S. 12, R.25, R. 38(7),(8)] |

|

||||||||||

|

9. |

Registration/approval from other sectoral regulators [Proviso to R. 12] |

In case pursuing of any of the objects of NewCo requires registration/approval from sectoral regulators such as RBI, SEBI ⟶ registration or approval, as the case may be, from such regulator shall be obtained by the proposed NewCo before pursuing such objects and a declaration in this behalf shall be submitted at the stage of incorporation of NewCo |

||||||||||

|

10. |

Simplified Proforma for Incorporating Company Electronically Plus (SPICe+) [R. 38] |

• Filings in respect of incorporation of a NewCo:

|

||||||||||

|

||||||||||||

|

||||||||||||

|

11. |

Additional requirement for incorporation of a S. 8 Co with Charitable objects, etc. [R. 19] |

Effective 15-Aug-2019, Application by promoters for license u/s 8 at the time of incorporation is also forming part of Form INC 32 (SPICe/ SPICe+, as the case may be) which is the form for incorporation. Accordingly final executed MoA and AoA are required to be attached to Form INC 32 (SPICe+) as against draft MoA & AoA in Form No. INC 12 earlier. Application for license u/s 8 by existing Cos u/R 20 will continue to be made in Form No. INC 12 |

||||||||||

|

12. |

OPC [R.4] |

|

||||||||||

|

13. |

5Commencement of business etc [R.10A] {Please also refer Special measures incl. Key CoVID 19 effects} |

|

||||||||||