Direct Taxes

- Accountant’s Reports under the Income-tax Act

- Amalgamation and Demergers

- Appeals

- Audit Reports under the Income-Tax Act/ Accountant’s Reports under the Income-tax Act

- Capital Gains

- Capital Gains on Specific Transfers

- Charitable Trusts

- Clubbing Provisions

- Co-operative Society – Taxation

- Deductions and Rebates

- Deemed Dividend

- Direct Tax Vivad Se Vishwas Act, 2020

- Double Taxation Avoidance Agreement

- Exempt Capital Gains

- Exempt Income

- Forms of I-Tax Act

- Full value of consideration in respect of transfer of Immovable Property held as business asset – Section 43CA

- Gifts Treated as Income

- Important Due Dates under Direct Taxes

- Income Computation & Disclosure Standard

- Income from House Property

- Interest

- Interpretation of Taxing Statutes

- Investment Planner

- Legal Maxim

- Minimum Alternate Tax (MAT) and Alternate Minimum Tax (AMT)

- Penalties

- Permanent Account Number (PAN)

- Presumptive Taxation

- Rates of Depreciation

- Rates of Income Tax

- Rectifications

- Return of Income

- Revision

- Salaries

- Search/Survey – Rights and Duties

- Section 14A : Disallowance of Expenditure incurred in relation to income exempt from tax

- Set-off and carry forward of losses

- Settlement Commission

- Statement of Financial Transactions or Reportable Account Annual Information Return (Section 285BA, Rule 114E)

- Tax Deduction and Collection Account Number (TDCAN)

- Taxation of Firms

- TDS Chart

Capital Gains on Specific Transfers

(‘C.A.’ refers to Capital Assets) TABLE 2

|

Section |

Particulars of transfer |

Capital Gains assessable in the hands of |

Year in which chargeable |

Amount deemed to be the full value of consideration for the purpose of S. 48 |

|---|---|---|---|---|

|

45(1A) |

Moneys/other assets received from insurance co. towards damage/destruction of C.A. due to certain specified natural calamities |

The person receiving the money/assets |

Year in which moneys/other asset is received from insurance co. |

Value of moneys/FMV of assets received from insurance co. |

|

45(2) |

Conversion of C.A. into stock-in-trade |

The owner of such asset |

Year in which sale or transfer of stock-in-trade takes place |

FMV of the asset on date of conversion |

|

45(2A) |

Transfer of Securities made by depository. (Refer note 1) |

The beneficial owner of the securities |

Year in which such securities are transferred |

Amount of consideration received |

|

45(3) |

Transfer of C.A. by a person to firm/AOP/BOI as his capital contribution or otherwise |

The partner or the member so transferring |

Year in which asset is so transferred |

The amount recorded in the books of the firm/AOP/BOI |

|

45(4) |

Transfer of C.A. by way of distribution thereof on dissolution of firm/AOP/BOI or otherwise |

The firm/AOP/BOI |

Year of distribution |

FMV on the date of distribution |

|

45(5) |

Transfer of C.A. by compulsory acquisition under any law OR transfer where consideration determined/approved by Central Govt./RBI

|

The transferor The transferor |

Year in which initial compensation is first received Year in which enhanced compensation is first received Proviso inserted w.e.f. 1-4-2015 – any amount of compensation received in pursuance of an interim order of a Court, Tribunal or other authority shall be deemed to be income chargeable in the year in which the final order of such court, Tribunal or other authority is made. |

Amount of initial compensation as reduced by order of any Court/Tribunal/other authority Enhanced amount (cost of acquisition and improvement are deemed to be NIL) as reduced by order of any Court/Tribunal or other authority |

|

45(5A) |

Transfer of land or building or both under specified agreement for development of a real estate project in consideration for a share in the land or building or both in the said project with or without cash consideration. |

The transferor being an individual or HUF |

Year in which the certificate of completion for the whole or part of the project is issued by the competent authority (authority empowered to approve the building plan) |

Stamp duty value on the date of issue of the certificate, of his share, in land or building or both in the project, increased by cash the consideration received (if any) |

|

45(6) |

Transfer of units referred to in S. 80CCB(2) by way of repurchase |

The transferor |

Year in which repurchase takes place |

The repurchase price |

|

46(2) |

Distribution of assets of a Company to its share holders on its liquidation |

The shareholder |

Year in which the share holder receives any money or other assets |

Moneys received from the Co. + Market value of other assets on the date of distribution less amount assessed as deemed dividend u/s. 2(22)(c) |

|

46A |

Purchase by a company of its own shares/specified securities (buy back of shares) |

The shareholder or the holder of the specified securities |

Year in which such shares or other specified securities purchased by the company |

Amount received from the company |

|

Proviso to |

Shares, debentures, warrants allotted to employees under Employees Stock Option Plan or Scheme framed in accordance with guidelines issued by the Central Government |

The employee |

Year in which shares, debentures, warrants are transferred under a gift or an irrevocable trust to the employee |

FMV on the date of its transfer |

|

50B |

Slump sale of Capital Assets or business undertaking |

The transferor |

Year in which slump sale takes place |

The value received/receivable as the sale |

|

50C |

Transfer of land or building |

The transferor |

Year in which asset is transferred |

Higher of : (i) sale consideration (ii) value adopted/assessed/assessable by State Government for stamp duty valuation (only if it exceeds 105% of the sale consideration upto 31-3-2020 and 110% of sale consideration after 1-4-2020) |

|

50CA |

Transfer of unquoted shares (i.e. not quoted regularly on any recognised stock exchange) of the company (Note No. 5) |

The transferor |

Year in which consideration is received or accrued |

FMV of share determined in a prescribed manner where consideration paid/accrued is less than such FMV |

Note :

- As per Circular No. 768, dated 24th June, 1998, FIFO method shall be followed in case of dematerialised securities. Where the investor has more than one security account, FIFO method shall be followed account wise.

- As per Section 55A the AO may refer to the Valuation Officer for ascertaining the fair market value of the asset under following circumstances:

- Where in view of the AO the value of the asset claimed by the assessee in accordance with the estimate made by a registered valuer, is less than is FMV or (w.e.f. 1-7-2012, section 55A, clause (a) is amended as follows:

- Where in view of the AO, the value of the asset claimed by the assessee in accordance with the estimate made by a registered valuer is at variance with its fair market value)

- Where in view of the AO the value of the asset claimed by the assessee is less than the FMV by so much percentage or by so much amount as may be prescribed or

- Having regard to the nature of the asset and other relevant circumstances, it is necessary to do so.

- Where in view of the AO the value of the asset claimed by the assessee in accordance with the estimate made by a registered valuer, is less than is FMV or (w.e.f. 1-7-2012, section 55A, clause (a) is amended as follows:

- As per section 50D (with effect from 1st April, 2013), where the consideration received or accruing as a result of the transfer of a capital asset by an assessee is not ascertainable or cannot be determined, then, for the purpose of computing income chargeable to tax as capital gains, the fair market value of the said asset on the date of transfer shall be deemed to be the full value of the consideration received or accruing as a result of such transfer.

- The definition of agricultural land has been amended and divided into three categories based on population and shortest aerial distance. Notification by Central Government now not required.

- W.e.f 1st April 2020, Finance Act 2019 has inserted a proviso in section 50CA to provide that these provisions shall not apply to certain prescribed category of consideration/class of persons, subject to the conditions as may be prescribed

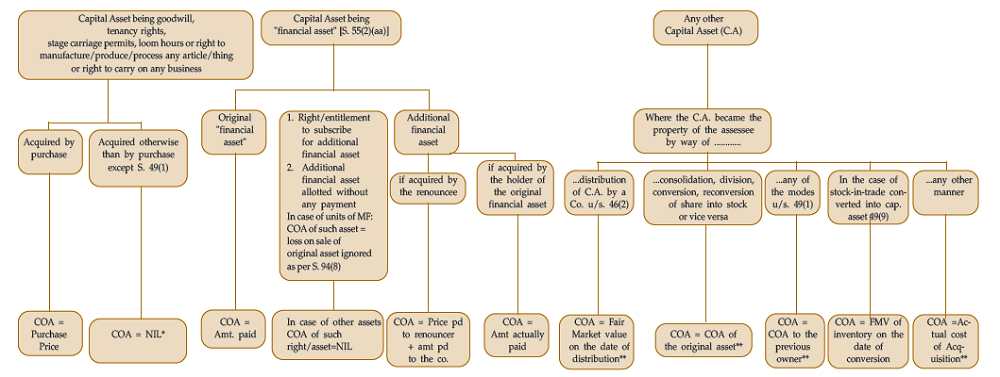

COST OF ACQUISITION

Note: As per Finance Act, 2018, for computing long-term Capital Gains on specified assets mentioned below being sold after 31st January 2018, the cost of acquisition shall be deemed to be higher of:

- The actual cost of acquisition of such asset, and

- The lower of:

- The fair market value of such asset (highest price of share on stock exchange on 31st January, 2018 or when the share was last traded

- The sale value accrued when the share/unit is sold.

The long-term capital gain/loss on such specified assets mentioned below shall be calculated as sales consideration less cost of acquisition as determined above

For equity shares and equity oriented units other than specified asset mentioned below, there gains shall be calculated as sales consideration – actual cost of acquisition.

Specified assets being:

- Equity share in a company, Unit of equity oriented fund. Unit of business trust acquired on or before 31st January, 2018 where STT has been paid on transfer of such unit

* Provision deeming cost of acquisition of self generated goodwill as Nil not applicable to professional firms and cases of notional transfers; e.g., when a person becomes a partner [CBDT Cir. No. 495 of 22-9-1987 168 ITR (St) 87, 105, 106.]

** In case of any capital asset (other than goodwill, trademark, brand name, tenancy rights, stage carriage permit, loom hours or right to manufacture etc.), acquired by the assessee (or the previous owner) before 1-4-1981, the fair market value of the asset as on 1-4-1981 may, at the option of the assessee, be treated as cost of acquisition.

Note: Where the cost to the previous owner cannot be ascertained the cost of acquisition to the previous owner means the fair market value on the date on which the capital asset became the property of the previous owner. [Sec. 55(3)] The provisions of section 49(2AAA) are inserted by Finance Act, 2010.

Finance Act, 2015 inserted sub-section (2AD) to section 49 which states that where the capital asset, being a unit or units in a consolidated scheme of a mutual fund, became the property of the assessee in consideration of a transfer referred to in clause (xviii) of section 47, the cost of acquisition of the asset shall be deemed to be the cost of acquisition to him of the unit or units in the consolidating scheme of the mutual fund.

The Finance Act, 2015 has provided that the period of holding in case of shares which are acquired on redemption of GDRs as referred to in section 115AC(1)(b) shall be reckoned from the date on which a request for redemption is made by the assessee.

The cost of acquisition shall be computed in accordance with sub-section (2ABB) as inserted in section 49 by the Finance Act, 2015.

The cost of acquisition of shares acquired by a non-resident on redemption of GDRs shall be the price of such shares as prevailing on any recognised stock exchange on the date on which a request for redemption is made by the assessee.

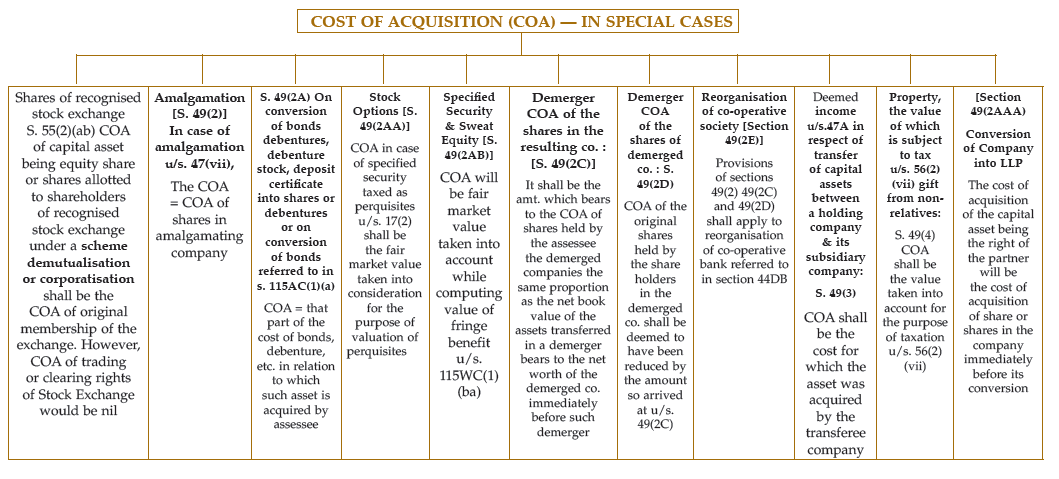

Table – 3.2 Cost of acquisition in special cases

|

Cost of acquisition (COA) - In special cases |

|||

|---|---|---|---|

|

Sr. No. |

Particulars |

Section |

Cost of acquisition |

|

1 |

Shares of recognised stock exchange |

Section 55(2) (ab) |

|

|

2 |

Amalgamation under Section 47(vii) |

Section 49(2) |

|

|

3 |

On conversion of bonds debentures, debenture stock, deposit certificate into shares or debentures or on conversion of bonds referred to in Section 115AC(1)(a) |

Section 49(2A) |

|

|

4 |

Stock Options |

Section 49(2AA) |

|

|

5 |

Conversion of Company into LLP |

Section 49(2AAA) |

|

|

6 |

Specified Security and Sweat Equity |

Section 49(2AB) |

|

|

7 |

Share (s) acquired by non-resident on redemption of GDRs as referred to in Section 115AC(1)(b) |

Section 49(2ABB) |

|

|

8 |

Unit of business trust becomes the property in consideration of transfer referred in Section 47(xvii) |

Section 49(2AC) |

|

|

9 |

Unit(s) in a consolidated scheme of a mutual fund became the property in consideration of a transfer referred to Section 47(xviii) |

Section 49(2AD) |

|

|

10 |

Equity share of a company, became the property of the assessee in consideration of a transfer [referred to in Section 47(xb)] |

Section 49(2AE) w.e.f. 1 April 2018 |

|

|

11 |

Unit or units in a consolidated plan of a mutual fund scheme, became the property of the assessee in consideration of a transfer [referred under Section 47(xix)] |

Section 49(2AF) w.e.f. 1.4.2017 |

|

|

12 |

Demerger - COA of the shares in the resulting company |

Section 49(2C) |

|

|

13 |

Demerger - COA of the shares of demerged company |

Section 49(2D) |

|

|

14 |

Reorganisation of co-operative bank |

Section 49(2E) |

|

|

15 |

Units or units in the segregated portfolio |

Section 49(2AG) |

|

|

16 |

Original units in the main portfolio after segregation of portfolio. |

|

|

|

17 |

Deemed income under section 47A in respect of transfer of capital assets between a holding company and its subsidiary company |

Section 49(3) |

|

|

18 |

Property, the value of which is subject to tax under section 56(2)(vii), 56(2)(viia) or 56(2)(x), gift from non-relatives |

Section 49(4) |

|

|

19 |

Transfer of an asset declared under the Income Disclosure Scheme, 2016 and tax, surcharge and penalty is paid on the fair value of the asset on the date of commencement of this Scheme |

Section 49(5) |

COA shall be deemed to be the fair value of the asset which is taken into account for the purpose of Income Disclosure Scheme, 2016 |

|

20 |

Capital Gains on transfer of specified capital asset [referred in clause (c) of the Explanation to Section 10(37A)], after expiry of 2 years from the end of the financial year in which the possession was given to the assessee |

Section 49(6) |

COA is deemed to be its stamp duty value as on the last day of the 2nd financial year |

|

21 |

Capital Gains on transfer of share in the project being land or building or both (referred in section 45(5A)) and not being the capital asset referred to in the proviso of such sub-section) |

Section 49(7) |

COA is the amount which is deemed as full value of consideration in that sub-section |

|

22 |

Capital Gains on transfer of asset held by a trust or an institution in respect of which accreted income has been computed and tax paid (under Chapter XII-EB), |

Section 49(8) |

COA of such asset is deemed to be the FMV of the asset considered for computation of accreted income as on the specified date referred in Section 115TD(2) |

|

23 |

Transfer of Capital Asset held as stock-in-trade before conversion into Capital Asset |

Section 49(9) |

COA of such asset is deemed to the FMV of the inventory which is converted into Capital Asset and considered for computation of business income as per the provisions of clause (via) of Section 28 |

* Provisions of deeming cost of acquisition of self-generated goodwill as Nil not applicable to professional firms and cases of notional transfers; e.g., when a person becomes a partner [CBDT Cir. No. 495 of 22nd September 1987 168 ITR (St) 87, 105, 106.]

** In case of any capital asset (other than goodwill, trademark, brand name, tenancy rights, stage carriage permit, loom hours or right to manufacture etc.), acquired by the assessee (or the previous owner) before 1st April 1981, the fair market value of the asset as on 1st April 1981 may, at the option of the assessee, be treated as cost of acquisition. W.e.f 1st April 2018, the base year for computing indexed cost of acquisition or indexed cost of improvement is shifted from 1st April, 1981 to 1st April, 2001. However from A.Y.2021-22 where the capital asset is land or building or both, the fair market value of such asset as on 1-4-2001 shall not exceed SDV of the same as on 1-4-2001

Note: Where the cost to the previous owner cannot be ascertained the cost of acquisition to the previous owner means the fair market value on the date on which the capital asset became the property of the previous owner [Section 55(3)].