Indirect Taxes

- Customs

- Customs

- Advance Rulings

- Audit

- Background

- Classification of Goods under The Customs Tariff Act, 1975

- Customs Duty Drawbacks

- Date for Determining Rate of Duty and Valuation

- Demand, Recovery and Refund of Duty

- Interest

- Levy of Customs Duty

- Penalties

- Procedure of Import

- Prosecution

- Settlement of Cases

- Some Important Definitions

- Types of Duties

- Valuation of Goods

- Warehousing

- Goods and Services Tax (GST)

- Goods and Services Tax (GST)

- Accounts and Records

- Assessments and Audits

- Classification of Goods and Services

- E-Way Bill

- Input Tax Credit (ITC)

- Interest

- Penalties & Prosecution

- Place of Supply

- Refund

- Registration

- Relevant Circulars - Miscellaneous

- Returns

- Reverse Charge Mechanism under Goods and Services Tax (GST)

- Supply with Schedules

- Time of Supply

- Transitional Provisions

- Valuation of Supplies

- Maharashtra Profession Tax

- Maharashtra Value Added Tax

- Maharashtra Value Added Tax

- Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019

- Service Tax

INPUT TAX CREDIT (ITC)

Input Tax Credit or to say ITC mechanism is the backbone of any system of Value Added Taxation (VAT). Goods and Services Tax (GST), being based upon the principles of VAT, it has to provide for an appropriate mechanism by which the basic concept of VAT remains intact. As we are well aware, GST is a destination based tax, the burden of tax has to be borne by the ultimate consumer of goods or services as the case may be. Neither there should be any cascading of taxes nor any burden of such tax should fall on businesses.

Businesses, in any country, operate through a chain of people performing different activities, and, sometimes it is a very long chain between origin of goods and its consumption in the hands of ultimate consumer. An importer or manufacturer may be the first person in the chain of production and distribution of goods. Thereafter, there may be a distributor, a stockist, a wholesaler or a trader and the retailer, etc. Thus, before the goods reach the hands of ultimate consumer, they pass through various hands, and, each such person may be adding some value to such goods whether by way of enhancing its utility or otherwise whereby the price of such goods gets increased at each stage in that chain of production and distribution.

This concept of ITC is not new to all those who have been dealing with Excise Duty, Service Tax and State VAT laws, wherein it already exits either partially or fully in the form of CENVAT and setoff, etc. But, as these taxes are being levied at different stages and by different Government/s, there is no inter connectivity of these taxes and therefore taxes paid under one or more enactments are not cenvatable against the other. It is fragmented VAT, which is in practice in our country at present.

The Indian GST law i.e., the Central Goods and Services Act (CGST Act), IGST Act, UTGST Act as well as State GST Acts contain elaborate provisions regarding input tax credit and claim thereof by eligible taxable persons. The Rules made there under provide conditions for such claim. As the provisions and the conditions are on the same line in all such enactments, the provisions contained in CGST Act and the Rules are discussed as follows:

Input, Input Tax and Input Tax Credit

Section 2 of the Central Goods & Services Act defines various terminologies. Relevant definitions are reproduced herein as follows:—

(59) “input” means any goods other than capital goods used or intended to be used by a supplier in the course or furtherance of business;

(60) “input service” means any service used or intended to be used by a supplier in the course or furtherance of business;

(62) “input tax” in relation to a registered person, means the central tax, State tax, integrated tax or Union territory tax charged on any supply of goods or services or both made to him and includes—

- the integrated goods and services tax charged on import of goods;

- the tax payable under the provisions of sub-sections (3) and (4) of section 9;

- the tax payable under the provisions of sub-sections (3) and (4) of section 5 of the Integrated Goods and Services Tax Act;

- the tax payable under the provisions of sub-sections (3) and (4) of section 9 of the respective State Goods and Services Tax Act; or

- the tax payable under the provisions of sub-sections (3) and (4) of section 7 of the Union Territory Goods and Services Tax Act,

but does not include the tax paid under the composition levy;

(63) “input tax credit” means the credit of input tax;

(67) “inward supply” in relation to a person, shall mean receipt of goods or services or both whether by purchase, acquisition or any other means with or without consideration;

(19) “capital goods” means goods, the value of which is capitalised in the books of account of the person claiming the input tax credit and which are used or intended to be used in the course or furtherance of business;

(94) “registered person” means a person who is registered u/s. 25 but does not include a person having a Unique Identity Number;

(105) “supplier” in relation to any goods or services or both, shall mean the person supplying the said goods or services or both and shall include an agent acting as such on behalf of such supplier in relation to the goods or services or both supplied;

(106) “tax period” means the period for which the return is required to be furnished;

(107) “taxable person” means a person who is registered or liable to be registered u/s. 22 or section 24;

(108) “taxable supply” means a supply of goods or services or both which is leviable to tax under this Act;

(47) “exempt supply” means supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax u/s. 11, or u/s. 6 of the Integrated Goods and Services Tax Act, and includes non-taxable supply;

(78) “non-taxable supply” means a supply of goods or services or both which is not leviable to tax under this Act or under the Integrated Goods and Services Tax Act;

Eligibility to Claim Input Tax Credit

Section 16(1) of the CGST Act provides that: Every registered person is entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business.

Thus, to claim Input Tax Credit (ITC) it is necessary that the claimant is a ‘registered person’. All such persons who are registered under the Act (other than persons holding UIN) are eligible to claim ITC in respect of taxes paid (i.e., CGST, SGST or UTGST and IGST) on all inward supplies of goods and services received, which are used or intended to be used in the course of his business or for furtherance of business.

Such inward supplies may be of inputs, input services or capital goods. All such supplies are eligible for claim of ITC. Thus, whether it is raw material, packing material, trading goods, consumables, capital goods or items of expenditure (debited to Profit & Loss a/c under various heads) all such items are eligible provided the same are used or intended to be used in the course or furtherance of business (subject to such conditions and restrictions as may be prescribed).

Conditions & Restrictions

Apart from the basic condition i.e., used or intended to be used in the course or furtherance of business, section 16(2) provides for certain conditions, which may be summarised as follows:

- The recipient must be in the possession of a tax invoice (issued by the supplier) in respect of such supply

- Goods and/or services (as the case may be) must have been received.

w.e.f 1-2-2019 it shall be deemed that the registered person has received the goods or, as the case may be, services—

- where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise

- where the services are provided by the supplier to any person on the direction of and on account of such registered person.

- Tax charged on such inward supply must have been paid to the Government (whether in cash or by way of utilisation of ITC)

- A return (in accordance with section 39) has been furnished

- In respect of capital goods, if the registered person has claimed depreciation (under the Income-tax Act) on tax component of such assets (capital goods), ITC shall not be admissible. That would mean that if tax component has been added to the cost of such capital goods, ITC to that extent is not eligible.

It has further been provided that if the recipient fails to make payment to the supplier in respect of supplies so received (on which ITC has been claimed) within a period of 180 days from the date of issuance of Tax Invoice, the ITC so claimed has to be reversed along with interest. And such amount can be reclaimed on making payment to the supplier.

43A. Procedure for furnishing return and availing input tax credit [to be effective from date to be notified]

- Notwithstanding anything contained in sub-section (2) of section 16, section 37 or section 38, every registered person shall in the returns furnished under sub-section (1) of section 39 verify, validate, modify or delete the details of supplies furnished by the suppliers.

- Notwithstanding anything contained in section 41, section 42 or section 43, the procedure for availing of input tax credit by the recipient and verification thereof shall be such as may be prescribed.

- The procedure for furnishing the details of outward supplies by the supplier on the common portal, for the purposes of availing input tax credit by the recipient shall be such as may be prescribed.

- The procedure for availing input tax credit in respect of outward supplies not furnished under sub-section (3) shall be such as may be prescribed and such procedure may include the maximum amount of the input tax credit which can be so availed, not exceeding twenty per cent of the input tax credit available, on the basis of details furnished by the suppliers under the said sub-section.

- The amount of tax specified in the outward supplies for which the details have been furnished by the supplier under sub-section (3) shall be deemed to be the tax payable by him under the provisions of the Act.

- The supplier and the recipient of a supply shall be jointly and severally liable to pay tax or to pay the input tax credit availed, as the case may be, in relation to outward supplies for which the details have been furnished under sub-section (3) or sub-section (4) but return thereof has not been furnished.

- For the purposes of sub-section (6), the recovery shall be made in such manner as may be prescribed and such procedure may provide for non-recovery of an amount of tax or input tax credit wrongly availed not exceeding one thousand rupees.

- The procedure, safeguards and threshold of the tax amount in relation to outward supplies, the details of which can be furnished under sub-section (3) by a registered person,—

- within six months of taking registration;

- who has defaulted in payment of tax and where such default has continued for more than two months from the due date of payment of such defaulted amount, shall be such as may be prescribed.

Reduction in ITC

Section 17 provides for certain conditions in which the claim of ITC may get reduced to certain extent or proportionate reduction may have to be worked out in following circumstances:—

- If the taxable supplies received are used partly for the purposes of business and partly for any other purposes (may be for personal use). ITC will be admissible to the extent of business uses only. If the exact amount is not ascertainable then proportionate reduction method will be applicable.

- If the taxable supplies received are used partly for the purposes of outward supply of taxable goods and/or services (including zero rated supplies) and partly for exempt supplies, ITC will be admissible to the extent of use in taxable supplies including zero rated supplies) [Refer Rule 42 & 43]. If the exact amount is not ascertainable then proportionate reduction method will be applicable.

Note: ‘Zero Rated supplies’ are defined u/s. 16 of IGST Act as follows:—

“16. (1) “zero rated supply” means any of the following supplies of goods or services or both, namely:–

- export of goods or services or both; or

- supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.”

Thus, although there is no tax payable on outward supplies, which are zero rated, input tax credit is available in full (without any reduction).

Explanation. W.e.f. 01-02-2019 —For the purposes of this sub-section, the expression "value of exempt supply" shall not include the value of activities or transactions specified in Schedule III, except those specified in paragraph 5 of the said Schedule.

- A banking company or a financial institution including a non-banking financial company, engaged in supplying services by way of accepting deposits, extending loans or advances shall have the option to either comply with the provisions of section 17(2) (i.e. bifurcation of taxable and exempt supplies), or avail of, every month, an amount equal to fifty per cent of the eligible input tax credit on inputs, capital goods and input services in that month and the rest shall lapse.

Blocked Credits

Section 17(5) of the CGST Act provides that; Notwithstanding anything contained in sub-section (1) of section 16 and sub-section (1) of section 18, input tax credit shall not be available in respect of the following, namely:—

(a) motor vehicles for transportation of persons having approved seating capacity of not more than 13 persons (including the driver), except when they are used for making the following taxable supplies, namely:—

- further supply of such vehicles or conveyances; or

- transportation of passengers; or

- imparting training on driving, flying, navigating such vehicles or conveyances;

(aa) vessels and aircraft except when they are used—

- for making the following taxable supplies, namely:—

- further supply of such vessels or aircraft; or

- transportation of passengers; or

- imparting training on navigating such vessels; or

- imparting training on flying such aircraft;

- for transportation of goods;

(ab) services of general insurance, servicing, repair and maintenance in so far as they relate to motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa):

Provided that the input tax credit in respect of such services shall be available—

- where the motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) are used for the purposes specified therein;

- where received by a taxable person engaged—

- in the manufacture of such motor vehicles, vessels or aircraft; or

- in the supply of general insurance services in respect of such motor vehicles, vessels or aircraft insured by him;

(b) The following supply of goods or services or both—

- Food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery, leasing, renting or hiring of motor vehicles, vessels or aircraft referred to in clause (a) or clause (aa) except when used for the purposes specified therein, life insurance and health insurance:

Provided that the input tax credit in respect of such goods or services or both shall be available where an inward supply of such goods or services or both is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as an element of a taxable composite or mixed supply;

- Membership of a club, health and fitness centre;

- Travel benefits extended to employees on vacation such as leave or home travel concession;

Provided that the input tax credit in respect of such goods or services or both shall be available, where it is obligatory for an employer to provide the same to its employees under any law for the time being in force

- Works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service;

- Goods or services or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business.

Explanation.—For the purposes of clauses (c) and (d), the expression “construction” includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalisation, to the said immovable property;

- Goods or services or both on which tax has been paid u/s. 10 (composition schemes);

- Goods or services or both received by a non-resident taxable person except on goods imported by him;

- Goods or services or both used for personal consumption;

- Goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples; and

- Any tax paid in accordance with the provisions of sections 74, 129 and 130 (specific cases).

Explanation.– For the purposes of Chapter V (Input Tax credit) and Chapter VI (registration), the expression “plant and machinery” means apparatus, equipment, and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports but excludes—

- Land, building or any other civil structures;

- Tele-communication towers; and

- Pipelines laid outside the factory premises.

It may further be noted that following persons are not entitled to claim input tax credit in respect of any of the items of inward supply of goods or services:

- An unregistered person

- Registered persons who have opted for Composition Scheme

- Persons holding Unique Identification Number (UIN)

- A registered person whose registration is cancelled (in respect of inward supplies on or after the date of cancellation).

Documentation Requirements and Conditions for Claiming ITC

The input tax credit shall be availed by a registered person, including the Input Service Distributor, on the basis of any of the following documents prescribed under Rule 36, namely:—

- Tax invoice issued by the supplier of goods or services or both in accordance with the provisions of section 31;

- An invoice issued in accordance with the provisions of clause (f) of sub-section (3) of section 31, subject to payment of tax (i.e., in respect of purchases from unregistered dealers, where tax is payable under reverse charge scheme);

- A debit note issued by a supplier in accordance with the provisions of section 34 (in respect of goods return, rate difference, etc.);

- A bill of entry or any similar document prescribed under the Customs Act, 1962 or rules made thereunder for assessment of integrated tax on imports;

- An ISD invoice or ISD credit note or any document issued by an Input Service Distributor in accordance with the provisions of sub-rule (1) of rule invoice 7.

Time Limit for claim of ITC

The procedure to claim ITC by a registered person is that the same can be claimed immediately in respective month (Tax Period) to which the tax invoice relates (subject to actual receipt of such goods/services). Each such claim of ITC is credited to the Electronic Credit Register of such registered person. He may utilise the credit as and when he would like to adjust the same against his output tax liability.

However, if a person has not claimed ITC in the respective month, for any reason, he may claim the same any time (i.e., in any tax period) up to the due date of filing the return for the month of September following the end of financial year to which the invoice pertains or furnishing of the relevant Annual Return for the said financial year, whichever is earlier.

Provided that the registered person shall be entitled to take input tax credit after the due date of furnishing of the return under section 39 for the month of September, 2018 till the due date of furnishing of the return under the said section for the month of March, 2019 in respect of any invoice or invoice relating to such debit note for supply of goods or services or both made during the financial year 2017-18, the details of which have been uploaded by the supplier under sub-section (1) of section 37 till the due date for furnishing the details under sub-section (1) of said section for the month of March, 2019.

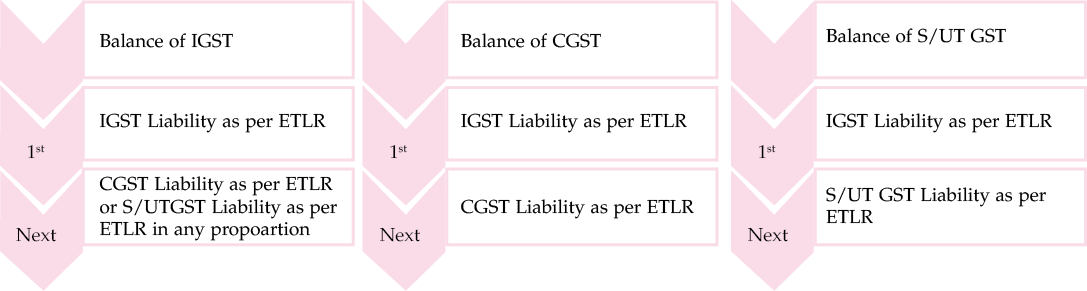

MANNER OF UTILISATION OF ITC

w.e.f 01-02-2019 sec 49A. Notwithstanding anything contained in section 49, the input tax credit on account of central tax, State tax or Union territory tax shall be utilised towards payment of integrated tax, central tax, State tax or Union territory tax, as the case may be, only after the input tax credit available on account of integrated tax has first been utilised fully towards such payment.