FEMA and International Taxation

- Foreign Contribution (Regulation) Act, 2010

- Foreign Contribution (Regulation) Act, 2010

- Accounts & Audit

- All FCRA services online

- Applicability

- Change of designated bank account, name, address, aim, objects or key members of the association

- Declaration of receipts of foreign contribution

- Foreign Contribution

- Inspection & Seizure

- Introduction

- Penalty

- Registration of the Association

- Restriction on Administrative Expenses

- Restrictions on acceptance of foreign hospitality

- Restrictions on Accepting FC

- Speculative Activity

- Total Ban on acceptance of Foreign Contribution & Hospitality

- Transfer of FC to other Registered or Unregistered Persons

- Foreign Exchange Management Act, 1999

- Foreign Exchange Management Act, 1999

- Acquisition and transfer of Immovable property in India

- Acquisition and Transfer of Immovable Property outside India

- Bank Accounts in India

- Borrowings from Non-residents

- Branch/Liaison/Project Office in INDIA

- Branch/Liaison/Project Office outside India

- Capital & Current Account Transactions

- Compounding & Contravention under FEMA

- Cross Border Merger Regulations

- Introduction

- Investment in India

- Miscellaneous

- Overseas Direct Investments

- Residential Status under FEMA

- Trade Transactions – Import & Export

- International Taxation

- International Taxation

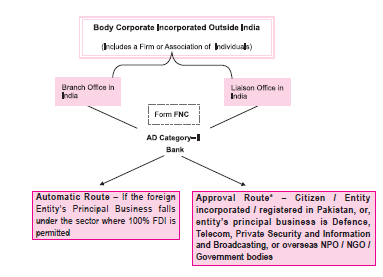

Branch / Liaison / Project Office in INDIA

* A citizen of or an entity registered/incorporated in Bangladesh, Sri Lanka, Afghanistan, Iran, China, Hong Kong or Macau opening a BO/LO/PO in Jammu and Kashmir, North East region and Andaman and Nicobar Islands also need to obtain prior permission of RBI.

Branch Offices/ Liaison Offices

|

Branch Office |

Liaison Office |

|

|

Track Record |

A profit making track record during the immediately Five Financial years in the home country |

A profit making track record during the immediately Three Financial years in the home country |

|

Net Worth** |

Not less than USD 100,000 or its equivalent. |

Not less than USD 50,000 or its equivalent. |

|

Permissible Activities |

|

|

** Total of paid-up capital and free reserves, less intangible assets as per the latest Audited Balance Sheet or Account Statement certified by a CPA or a Registered Account Practitioner

Branch Office in SEZ

RBI has granted General Permission to foreign companies for establishing branch/unit in Special Economic Zones (SEZ) to undertake manufacturing and service activities, subject to the following conditions:

- BO must function in those sectors where 100 per cent FDI is permitted;

- BO must comply with Part XXII of the Companies Act, 2013;

- BO must function on a standalone basis.

Branches of Foreign Banks

Foreign banks do not require separate approval under FEMA, for opening branch office in India provided they have obtained necessary approval under the provisions of the Banking Regulation Act, 1949, from Department of Banking Operations & Development, Reserve Bank.

Liaison Offices of Foreign Insurance Companies/Banks

Foreign Insurance companies can establish Liaison Offices in India only after obtaining approval from the Insurance Regulatory and Development Authority (IRDA).

Foreign banks can establish Liaison Offices in India only after obtaining approval from the Department of Banking Regulations (DBR), Reserve Bank of India.

The Hon’ble Supreme Court vide its interim orders dated July 4, 2012 and September 14, 2015 has directed RBI not to grant any permission to any foreign law firm, on or after the date of the said interim order, for opening of LO in India. However, foreign law firms which have been granted permission prior to the date of interim order for opening LOs in India may be allowed to continue provided such permission is still in force.

UIN & PAN

BO / LO are granted a Unique Identification Number by RBI. They are, upon setting-up office, required to obtain PAN under Income-tax Act, 1961. The BO can freely remit profits earned from India, subject to payment of applicable taxes.

Annual Activity Certificate

Every BO / LO is required to file an Annual Activity Certificate (AAC) at the end of March 31 along with the audited Balance Sheet with RBI, through its Bank as well as with the Director General of Income Tax (International Taxation), Drum Shape Building, I. P. Estate, New Delhi – 110 002, on or before September 30 of that year. The certificate is to be obtained from a Chartered Accountant.

Project Offices

RBI has granted general permission to those foreign companies to establish Project Offices in India who have secured a contract from an Indian company to execute a project in India, and:

- The project is funded directly by inward remittance from abroad; or

- The project is funded by a bilateral or multilateral International Financing Agency; or

- The project has been cleared by an appropriate authority; or

- A company or entity in India awarding the contract has been granted Term Loan by a Public Financial Institution or a bank in India for the project.

However, if the above criteria in respect of funding are not met, the foreign entity has to approach the Central Office of RBI for approval to set up a Project Office (PO) in India.

PO can, subject to certain conditions, open two non-interest bearing foreign currency accounts. Similarly, PO can, subject to certain conditions, make remittances pending winding up/ completion of the project.

Every BO/LO/PO has to file the following report (in the prescribed format) with the Director General of Police (DGP) of the State whether the BO/LO/PO is located:

- A report within five working days of the LO/BO/PO becoming functional; if there is more than one office of such a foreign entity, in such cases to each of the DGP concerned of the State where it has established office in India.

- A report has to be filed on annual basis along with a copy of the Annual Activity Certificate/Annual Report required to be submitted by LO/BO/PO concerned, as the case may be.

- A copy of report filed as above should also be filed with the Bank by the LO/BO/PO concerned.