Direct Taxes

- Accountant’s Reports under the Income-tax Act

- Amalgamation and Demergers

- Appeals

- Audit Reports under the Income-Tax Act/ Accountant’s Reports under the Income-tax Act

- Capital Gains

- Capital Gains on Specific Transfers

- Charitable Trusts

- Clubbing Provisions

- Co-operative Society – Taxation

- Deductions and Rebates

- Deemed Dividend

- Double Taxation Avoidance Agreement

- Exempt Capital Gains

- Exempt Income

- Forms of I-Tax Act

- Full value of consideration in respect of transfer of Immovable Property held as business asset – Section 43CA

- Gifts Treated as Income

- Important Due Dates under Direct Taxes

- Income Computation & Disclosure Standard

- Income from House Property

- Interest

- Interpretation of Taxing Statutes

- Investment Planner

- Legal Maxim

- Minimum Alternate Tax (MAT) and Alternate Minimum Tax (AMT)

- Penalties

- Permanent Account Number (PAN)

- Presumptive Taxation

- Rates of Depreciation

- Rates of Income Tax

- Rectifications

- Return of Income

- Revision

- Salaries

- Search/Survey – Rights and Duties

- Section 14A : Disallowance of Expenditure incurred in relation to income exempt from tax

- Set-off and carry forward of losses

- Settlement Commission

- Statement of Financial Transactions or Reportable Account Annual Information Return (Section 285BA, Rule 114E)

- Tax Deduction and Collection Account Number (TDCAN)

- Taxation of Firms

- TDS Chart

Gifts Treated as Income

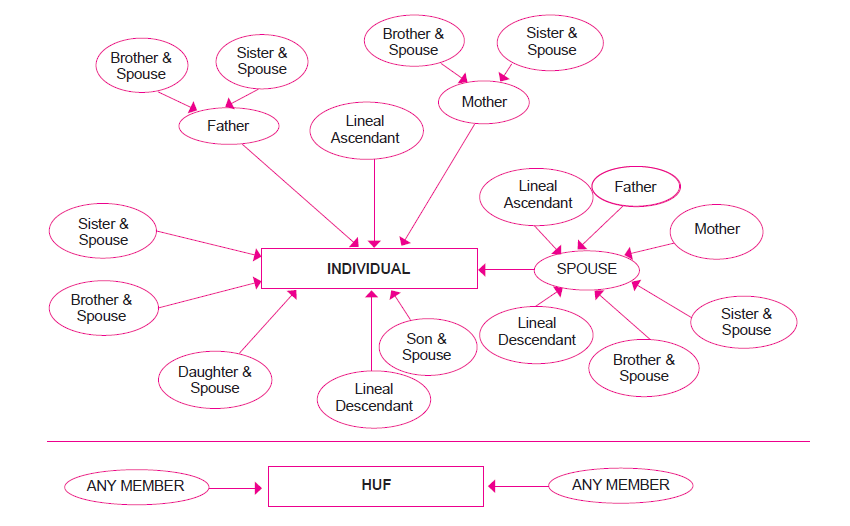

Generally, gifts received are not regarded as Income chargeable to tax. However, by virtue of section 2(24)(xiii) r.w.s. 56(2) any sum of money exceeding ₹ 50,000 received without consideration by an individual or an HUF from any person is chargeable to tax as Income under the head Other Sources, subject to following exceptions:

- Receipts from Relative. (Refer Chart at the bottom)

- Receipts at the time of Marriage.

- Receipts by way of Inheritances or by will

- Receipts Contemplation of Death

- Receipts from Local Authority u/s. 10(20)

- Receipts from Charitable Trust registered u/s. 12AA

- Receipts from fund/foundation/institution/hospital/medical institution referred in Sec. 10(23C)

- Receipt by a fund/foundation/hospital/medical institutions referred to in sub-clauses (iv), (v), (vi) and (via) of

Sec. 10(23C) - Receipts from certain specified restructuring (mentioned later)

- Receipts from a private trust created solely for the benefit of his relatives.

Also, it is pertinent to note that the taxation of gifts is to be looked upon from the recipient’s perspective.

List of Property – (to be treated as Gift)

- Immovable property being land or building or both;

- Shares and securities;

- Jewellery;

- Archaeological collections;

- Drawings;

- Paintings;

- Sculptures;

- Any work of art;

- Bullion (w.e.f. 1-6-2010)

Section 56(2) has been further amended and w.e.f. 1-4-2017, the scope of taxation on gifts is increased by taxing gifts in case of all the persons instead of the specified ones mentioned in 56(2)(vii) [S. 56(2)(x)]

|

Earlier |

Now |

|---|---|

|

Sections 56(2)(vii) & (viia) |

Section 56(2)(x) |

|

Applicable only in case of individual, HUF; Firm and Co. in certain cases, wherein, receipt of sum of money or property without or inadequate consideration in excess of₹ 50,000/- shall be chargeable to tax under income from other sources. |

This Section is newly inserted, wherein, any person receivingsum of money or property without or inadequate consideration in excess of ₹ 50,000/- shall be chargeable to tax under income from other sources. Finance Act 2019 has inserted a clause (XI) in the proviso to section 56(2)(x) w.e.f. 1st April 2020 to provide that these provisions shall not apply to certain prescribed category of consideration/class of persons, subject to the conditions as may be prescribed. |

Valuation of Gift in case of

- Immovable Property (being land or building or both)

56(2)(x)(b) – Immovable Property – Without Consideration

|

If SDV ≤50,000 |

If SDV > 50,000 |

||

|

Donor |

Donee |

Donee |

Donor |

|

Provisions not applicable |

Not considered as transfer u/s. 47(iii) – No Capital Gains |

SDV is income from other Sources u/s. 56(2)(x). COA will be SDV. Holding period will be counted from acquisition of property by donee. |

|

56(2)(x)(b) – Immovable Property – Inadequate Consideration

|

If SDV – Consideration value ≤50,000 |

If SDV – Consideration value > 50,000 and w.e.f AY 2019-20, SDV is more than 5% of consideration |

||

|

Donor |

Donee |

Donor |

Donee |

|

Provisions not applicable |

Section 50C will be applicable if Land & Building is capital Assets for Donor and Sale Consideration for Donor will be SDV. Capital Gains will be SDV less COA. Section 43CA will be applicable if Land & Building is not a capital Asset for Donor and Sale Consideration for Donor will be SDV. Income from PGBP will be SDV less COA. |

Difference of SDV and sales consideration is income from other Sources u/s. 56(2)(x), if the difference is higher than- (1) ₹ 50,000 and (2) 5% of the sales consideration. At the time of further sale, COA will be SDV and holding period will be counted from acquisition of property. |

|

It is also provided that in a case where the date of the agreement to purchase the property fixing the consideration and the date of registration are different, the taxability will be determined with reference to the stamp duty value on the date of agreement and not registration. This exception will apply only where at least part of the consideration has been paid by any mode other than cash, on or before the date of such agreement.

(ii) Any other property:

56(2)(x)(c) – Movable Property – Without Consideration

|

If FMV≤50,000 |

If FMV > 50,000 |

||

|

Donor |

Donee |

Donor |

Donee |

|

Provisions not applicable |

Not considered as transfer u/s. 47(iii) – No Capital Gain |

Fair Market Value (FMV) shall be income from other Sources u/s. 56(2)(x). COA will be FMV. Holding period will be counted from the date of acquisition of property by donee. |

|

56(2)(x)(c) – Movable Property at inadequate Consideration

|

If FMV – Consideration value ≤50,000 |

If FMV – Consideration value > 50,000 |

||

|

Donor |

Donee |

Donor |

Donee |

|

Provisions not applicable |

Not considered as transfer u/s. 47(iii) – No Capital Gains |

Difference of FMV and Consideration is income from other Sources u/s. 56(2)(x). At the time of further sale COA will be FMV and holding period will be counted from acquisition of property |

|

W.e.f. 1-6-2010 following items added u/s. 56(2)(viia) :

Receipt of shares of a closely-held company (on or before 1st June 2010 but before 1st April 2017) without consideration or inadequate consideration by firm (incl. LLP) or closely held company from closely held company is taxable.

Provision not applicable in case of the following restructuring:

- Transfer of shares of Indian company by amalgamating foreign company to amalgamated foreign company

- Transfer of shares of Indian company by demerged foreign company to resulting foreign company

- Transfer by shareholder of co-operative bank in a business reorganisation of a co-operative bank.

- Transfer by shareholder of shares of amalgamating company

- Transfer or issue by the resulting company, in a scheme of demerger,

- A resulting company pursuant to a scheme to a scheme of demerger; or

- An amalgamated Indian company pursuant to a scheme of amalgamation;

- A successor co-operative bank, in a business reorganisation, in lieu of shares of a predecessor co-operative bank.

Valuation rules for determining ‘fair market value of gifts’ Synopsis of the Rules:

The rules 11U, 11UA and 11UAA prescribes the different methods for the purpose of valuation of specified assets.

The determination of FMV, under these rules, will be for the purpose of section 56 and section 50CA of the Act.

Notification No. 23/2010, which came into force from 1st October, 2009 and Notification No. 61/2017, which came into force from 1st April, 2017. Further, specified assets received from relative are not covered by the provisions of section 56(2)(vii)/(x) of the Act.

Methods of Valuation:

- Valuation of specified assets (either than shares & securities)

|

Description of the property |

Basis of determination of FMV |

|---|---|

|

Specified assets other than shares and securities |

Estimated price which specified assets will fetch if sold in the open market on the valuation date |

|

In case if specified assets are received by the way of purchase on the valuation date from the Registered Dealer (means a dealer who is registered under Central Sales Tax Act, 1956 or General Sales Tax Law for the time being in force in any State including value added tax laws) |

FMV is the Invoice Value of the asset |

|

In case if specified assets are received by any other mode and the value of specified assets > ₹ 50,000 |

The assessee may obtain the report of registered valuer in respect of the price it would fetch if sold in the open market on the valuation date A registered valuer is a person who is entitled to function as registered valuer for the purpose of the Wealth Tax Act |

- Valuation of Shares & Securities

- Valuation of quoted shares & securities

|

Description of the property |

Basis of determination of FMV |

|---|---|

|

If quoted shares and securities are received by way of transaction carried out through any Recognised Stock Exchange (RSE) |

Transaction value recorded in such RSE |

|

If quoted shares and securities are received by way of transaction carried out other than through any RSE |

Lowest price quoted on any RSE on the valuation date If in case there is no trading on the valuation date, then, FMV will be lowest price on the date immediately preceding the valuation date when trading happened |

- Valuation of unquoted shares

|

Description of the property |

Basis for determination of FMV |

|

Unquoted Equity Shares |

Value as per the balance sheet (including notes thereto) on the valuation date in terms of the following formula: (A+B+C+D-L) x PV Where, A = Book value of assets (other than jewellery, artistic work, shares, securities and immovable property) in the balance sheet as reduced by –

B = The price which the jewellery and artistic work would fetch if sold in the open market on the basis of the valuation report obtained from a registered valuer; C = Fair market value of shares and securities as determined according to rule 11UA; D = The value adopted or assessed or assessable by any authority of the Government for the purpose of payment of stamp duty in respect of the immovable property L = Book value of liabilities shown in the balance sheet, excluding:

PE = Total amount of paid-up equity share capital PV = Paid-up value of such equity shares received |

|

Unquoted shares other than equity shares in a company which are not listed in any RSE |

Price it would fetch if sold in open market on the valuation date and the assessee is required to obtain a report from a Merchant Banker or a Chartered Accountant in support of the FMV |

Rule 11-UAA – Section 50CA applicable to transfer of unquoted shares

|

Description of the property |

Basis of determination of FMV |

|---|---|

|

Valuation of Unquoted Shares |

FMV to be determined in accordance with the above prescribed method (refer table 2 above) |

Section 56(2)(viib) applies to closely held company

|

Description of the property |

Basis for determination of FMV |

|---|---|

|

Any closely held company receives any consideration from resident person for issue of equity shares of closely held company > the face value of the shares |

Value as per the balance sheet (including notes thereto) on the valuation date in terms of the following formula: (A-L) x PV Where, A = Book value of assets in balance sheet less advance income-tax paid, any amount which does not represent the value of any asset, including debit balance in profit & loss account L = Book value of liabilities shown in the balance sheet, excluding:

PE = Total amount of paid-up equity share capital PV = Paid-up value of such equity shares received Or FMV of unquoted equity shares as determined by Merchant Banker as per the discounted free cash flow method |

|

Unquoted shares other than equity shares in a company which are not listed in any RSE |

Price it would fetch if sold in open market on the valuation date and the assessee is required to obtain a report from a Merchant Banker or a Chartered Accountant in support of the FMV |

Above provision does not apply to amount received by:

- Venture capital undertaking from a venture capital company, venture capital fund

- A specified fund (i.e. Category I or Category II Alternative Investment Funds)

- A “start up” company from a resident for issue of its shares. For an entity to qualify as a ‘start-up’, following conditions are to be fulfilled-

|

Particulars |

As per latest Notification (Notification No. G.S.R. 127(E) dated 19 February 2019; confirmed by CBDT vide Notification No. S.O.1131(E) dated 05 March 2019) |

As per old notification (Notification No. G.S.R. 364(E) dated 11 April 2018 as amended by Notification No. G.S.R. 34(E) dated 16 January 2019) |

|---|---|---|

|

Eligible activity – entity working towards |

Innovation, development or improvement of products or processes or services, or if it is a scalable business model with a high potential of employment generation or wealth creation |

|

|

Age of the entity i.e., from incorporation |

Up to 10 years |

Up to 7 years |

|

Turnover (in any FY from incorporation) |

Not exceeding ₹ 100 crore |

Not exceeding ₹ 25 crore |

For exemption from tax u/s. 56(2)(viib), following conditions are to be fulfilled by the startup-

|

Particulars |

As per latest Notification (Notification No. |

As per old Notification (Notification No. G.S.R. 364(E) dated 11 April 2018 as amended by Notification No. G.S.R. 34(E) dated 16 January 2019) |

|---|---|---|

|

Conditions |

|

|

|

Valuation Report |

Not called for |

Merchant banker valuation with documents |

A second proviso is inserted to section 56(2)(viib) w.e.f. 1st April, 2020 to provide that in case of failure to comply with any of the specified conditions in the notification, the consideration received by the company in excess of the face value of the shares shall be taxed as income of the year in which the failure takes place And it shall also be deemed that the company has under reported the said income and penalty provisions of Section 270A shall apply for the said previous year.

Forfeiture of Advance section 56(2)(ix)

Where any sum of money received as an advance or otherwise in the course of negotiations for transfer of Capital Assets, is forfeited and the negotiations do not result into transfer of such capital asset, then such sum shall be chargeable under this section as “Income from other sources”.